Sixty years onward from the formal end of the Jim Crow era, many American metro areas remain characterized by high rates of racial and income-based segregation. The Obama administration’s Affirmatively Furthering Fair Housing (AFFH) rule, an addendum to the Fair Housing Act, was intended to help remedy this. It required local governments receiving federal funding to analyze the demographic makeup of its neighborhoods and redress the discriminatory housing practices that hold back integration.

Since 2018, HUD had been working on revising AFFH, in part by shifting focus toward reforms that increase the supply of housing. One way to do this would be to encourage states and localities to reform zoning to encourage more multi-family housing, and eliminate land-use regulations– such as minimum lot sizes and parking requirements–that restrict new development. But in a dramatic reversal, President Trump and HUD Secretary Ben Carson recently vowed to “protect the suburbs” by repealing the AFFH entirely.

Trump and Carson’s repeal of AFFH relies on the idea that the suburbs are a “shining symbol of the American dream” — one that would be tarnished by the introduction of multi-family and affordable housing. Though this move has been criticized as a naked appeal to voters’ racial anxieties, some have defended the repeal as more faithful to the preferences of people of color and working families. The Senior Director of Policy for the Conservative Partnership Institute, Rachel Bovard has argued that AFFH negatively impacted working-class families, since “working families prefer single-family housing,” and that eliminating single-family zoning would prevent working families from building wealth through homeownership. This, she argued, is a sufficient reason to preserve and defend single-family zoning.

If this argument works, it will undercut the moral appeal of AFFH. And since Joe Biden promises to reinstate AFFH as part of his comprehensive housing plan, the issue is very much a live one. Nonetheless, Bovard’s argument simply doesn’t hold up.

Whose preference?

An increasing percentage of immigrants, people of color, and working families call the suburbs home. In 2013, over 60 percent of immigrants lived in the suburbs, compared to 56 percent in 2000. More than half of all minority groups living in large metro areas live in the suburbs, including 51 percent of blacks and 59 percent of Hispanics in 2010. This is part of a general trend towards increasing diversity in the suburbs.

According to Bovard, this is evidence that “families of all kinds prefer neighborhoods with single-family homes to the dense urban environment many want to leave behind.” But we can’t infer that the preference for single-family homes is the key driver of the move to the suburbs. There are myriad pull factors that attract people to the suburbs, including lower housing price-to-income ratios, better schools, more open space, and jobs. Indeed, for decades the suburbs had the highest job growth rates, although following the 2008 housing bubble, that trend has somewhat reversed. Thus, it’s hard to disentangle the preference for single-family homes from a general preference for the goods and services that come with suburban living, regardless of housing type.

Nor is the fact that a plurality of renters live in single-family homes decisive evidence of a revealed preference for these types of homes. America’s housing stock is old: the average age of an owner-occupied home (mostly single-family) is 37 years. According to a report on the Urban Institute’s housing supply, 54 percent of the occupied single-family housing stock was built before 1980. The dominance of single-family homes in the housing supply is thus not a result of the preferences of contemporary working-class families. Instead, it can be traced to the patchwork of single-family zoning policies that have restricted the construction of both newer and multi-family units.

While survey data on this is limited, market research commissioned by the real estate web search firm Redfin suggests that most people do prefer single-family homes. Yet at what cost? Life is all about trade-offs, so while many families may say they value having a big back yard and a white picket fence, they may also value proximity to a major metro area and housing options that don’t break the bank.

Importantly, no one had seriously proposed abolishing single-family housing. Rather, land-use liberalization is about permitting the construction of multi-family homes in places where current regulation makes them illegal. If the preference for single-family homes is as strong as Bovard claims, property owners will continue to build and maintain such homes despite having a new-found right to build additional units. As such, the only way zoning reform can possibly pose a threat to Bovard’s idealistic vision of the suburbs is if her core premise turns out to be false, and a large but latent preference for multi-family housing exists throughout the general population.

Single-family zoning makes homeownership less attainable

Assuming that people prefer to own single-family homes, single-family zoning makes this less, rather than more, attainable due to its effects on housing supply and the existing wealth gaps. Restrictive zoning artificially inflates home values by decreasing housing supply. This leads to higher prices, especially where demand is high.

Higher-than-necessary housing prices can have adverse effects on homeownership rates among people of color and the working class. Given the staggering racial wealth gap between whites and blacks, and the increasing income gap between the middle and lower-income families and upper-income families, restrictive zoning can make it harder for these groups to become homeowners. And in fact, large homeownership gaps persist among these groups. According to Census data, in the second quarter of 2020, 76 percent of non-Hispanic whites owned their homes, compared to only 47 percent of blacks. Just 55 percent of households with family income less than the median income owned their homes, compared to 80.5 percent of households with family income above or equal to the median.

Presenting single-family homeownership as the only good option, even if it is what most people ideally prefer, is misleading and obscures the panoply of other possibilities. “Missing middle” housing — duplexes, triplexes, and low-rise apartments — can function as starter homes for families with lower levels of wealth. As Daniel Takash argues, these missing-middle homes are what tends to be built in communities with liberalized zoning laws — not high-rise apartment buildings.

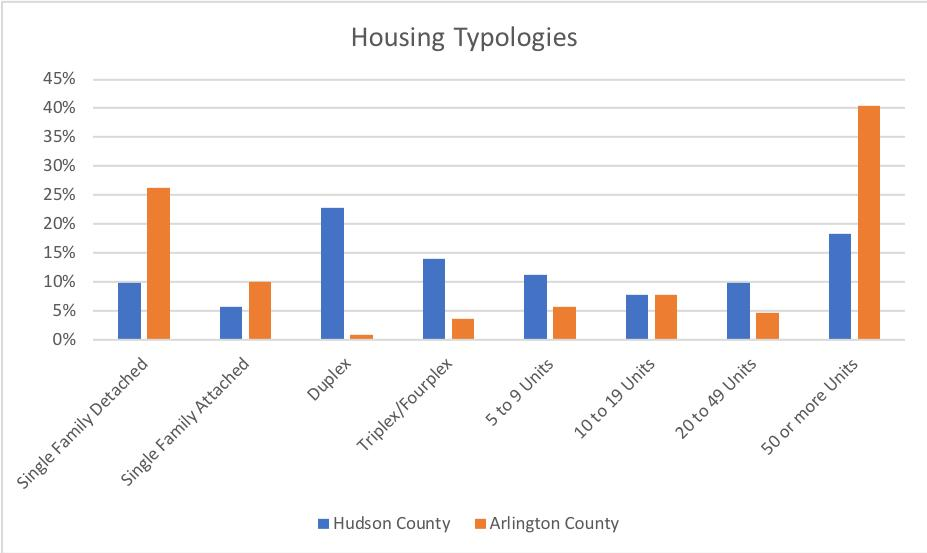

On the contrary, high-rise construction is often the by-product of stringent land-use regulation constraining new development to a tiny strip of land in an ocean of single-family zoning. To illustrate this, Emily Hamilton of the Mercatus Center compared the housing stock in Arlington County, Virginia, with Hudson County, the fastest-growing county in New Jersey. Arlington County has seen a great deal of development in recent years. Yet, because of zoning restrictions, new construction has been heavily concentrated in the narrow corridor that follows the metro line. This has led to a bar-bell shaped housing distribution, divided between ugly high-rise apartments and single-family detached homes a short walk in any direction.

Given that even modest deviations from the single-family model are often prohibited from being built, working families and people of color are forced into a false choice between single-family homeownership and the life of an eternal renter. Encouraging localities to eliminate restrictive zoning can thus help families build wealth by widening the range of available homeownership options.

Single-family zoning restricts access to opportunity

As mentioned above, critics of AFFH are often right to point out that the suburbs offer superior public goods, such as schools, safety, and public space. But because single-family zoning restricts the housing supply overall, access to such goods becomes tightly rationed, denying access to a broad swath of the working-class.

Those who are not born into economic advantage must be able to access these neighborhoods. A growing literature shows that neighborhoods are a key predictor of life outcomes. Children whose families move to better neighborhoods have better outcomes in terms of social mobility, teenage births, college attendance, and incarceration rates. If people of color and working families can’t afford to move to high-opportunity neighborhoods, then they cannot access the public goods and social networks that lead to superior outcomes. Eliminating single-family zoning is thus also an issue of fairness and equality of opportunity.

Indeed, increasing housing supply in high-demand regions is the only realistic, long-term strategy toward making both renting and home ownership more affordable. In many cases, this will require state governments to assume greater authority over land-use, along with nudges from the federal government to keep up the momentum for reform. Alternatively, if housing costs are allowed to continue to spiral upward in major metro areas, the demand for expedient solutions like a “renters tax credit” will only grow. Subsidizing demand while restricting supply would simply make the situation worse. But moreover, a federal subsidy for renters would grow the size of government while providing a massive transfer to landlords and urban professionals. To those who purport to care about reducing government size and supporting working-class families, the better of these two approaches should be clear.

This commentary is part of our Captured Economy of Cost Disease series exploring the political economy of debt and deficits. It is made possible thanks to the generous support of the Peter G. Peterson Foundation.