On January 28th, I participated in a forum at the Stanford Environmental and Energy Policy Analysis Center to discuss the agreement that came out of Paris last year to address climate change. On the panel with me was President Obama’s Special Envoy for Climate Change, Todd Stern, along with Matthew Rodriguez, California’s Secretary for Environmental Protection, and Trevor Houser, a partner at the Rhodium Group.

I found myself as something of a skunk at an august garden party. In the midst of a great deal of shared congratulation regarding the COP-21 agreement, I argued that the Paris treaty failed to do much of anything to address the risks of climate change, and there is little reason to think that the endless train of global climate confabs on the horizon will do any better. You can see all of the panel presentations and subsequent conversation here. My presentation (about ten minutes or so) is isolated here.

The massive gulf between what is required if we take IPCC reports seriously (as I do) and what is being delivered in the policy world is important. It explains why small-bore initiatives like clean energy subsidies, tax credits, clean energy deregulation, and energy efficiency mandates (those in place and those envisioned) are utterly inadequate to the task. It explains why crash R&D programs—even if eventually successful—are unlikely to reduce emissions in the time required. It explains why many in the environmental establishment, with their easy-sell clean energy policies and relatively unambitious regulatory initiatives, such as the Clean Power Plan, often strike well-informed conservatives as disingenuous.

Climate Ambitions

Let’s review the challenge we’ve established for ourselves: stopping the growth of CO2 concentrations in the atmosphere to limit global warming. The UNFCCC at Copenhagen (2009), and again in Paris, rallied around the goal of preventing warming in excess of 2°C over pre-industrial temperatures.

I see no reason to fight that goal.

Warming beyond 2°C puts us in a temperature range we have never before seen in human history. How the climate system will respond is unclear. Will the impacts from warming be linear or nonlinear? Are there temperature-related tipping points that could produce unforeseen abrupt and irreversible catastrophic climate events (see pp. 1114-1119)? We don’t know.

The range of variation between distinct climatic regimes is only on the order of around 5°C. The world was only 4°C cooler during the last ice age than prior to industrialization. Moving temperatures in the opposite direction flirts with equally extreme climate conditions. For instance, the last time the atmosphere had such high concentrations of greenhouse gases was perhaps during the middle of the Pliocene Epoch, some 3 million years ago. Temperatures then were only 2°C to 3.6°C above pre-industrial levels. There was no Arctic ice cap, however, and sea levels were 30-65 feet higher. Is that eventually what’s in store for us? Maybe. But in truth, who knows?

It is not even clear that preventing warming above 2°C eliminates the potential for catastrophic climate changes. A new study from James Hansen proposes a physical process that could accelerate the melting of the polar ice sheets and raise sea levels a few meters by the end of the century with only 2°C warming. Is that in store for us? It seems unlikely to Hansen’s colleagues, but it is not implausible.

Estimates of climate sensitivity tell us that the Earth will eventually warm somewhere between 1.5°C and 4.5°C if we double the amount of carbon dioxide in the atmosphere over pre-industrial levels (note to conservatives: most of the scientific skeptics marshaled by Republicans in Congressional hearings believe that future warming will likely be within that range, but on the low side). The most likely outcome of a doubling of atmospheric greenhouse gases is warming beyond 2°C, and we’re presently almost halfway to that doubling. Even if climate skeptics are right and climate sensitivity is low, warming exceeding 2°C should be expected by mid-century.

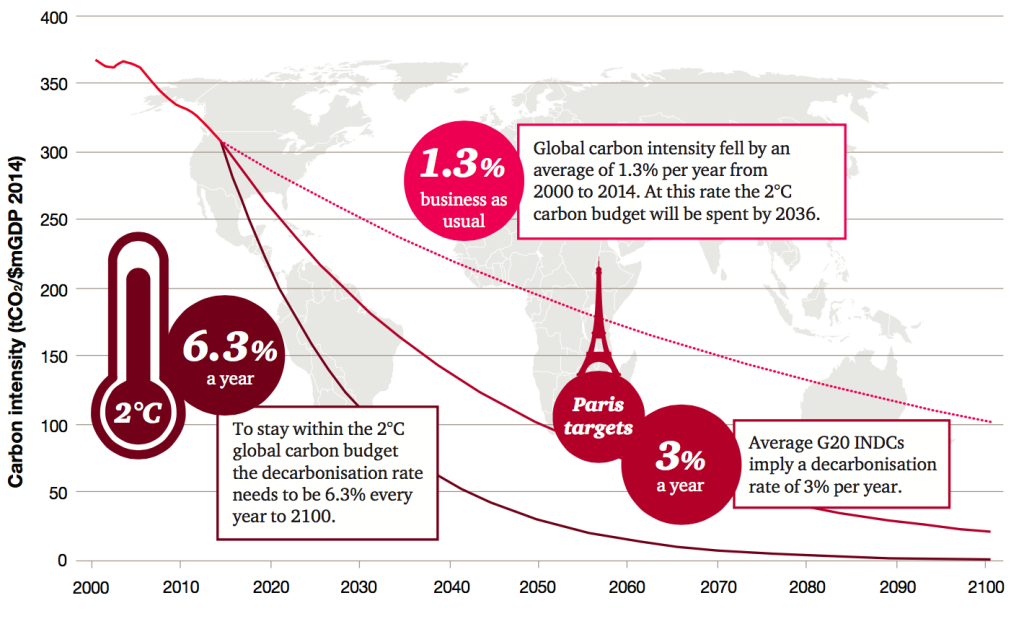

Some have argued that we’re presently on a rapid glide path to decarbonization. Conservatives take from this that market forces are already solving the climate problem. Environmentalists take from this that what we’re doing right now works and just a bit more policy effort will solve the climate problem.

Nonsense. While it’s true that the carbon intensity of GDP has fallen and continues to fall, it’s falling nowhere near fast enough to keep us from exceeding the 2°C goal. In fact, if decarbonization trends continue, we’ll blow through 2°C in a couple of decades and find ourselves on the high side of the IPCC’s emission scenarios by the end of the century.

Source: PwC

Policy Reality

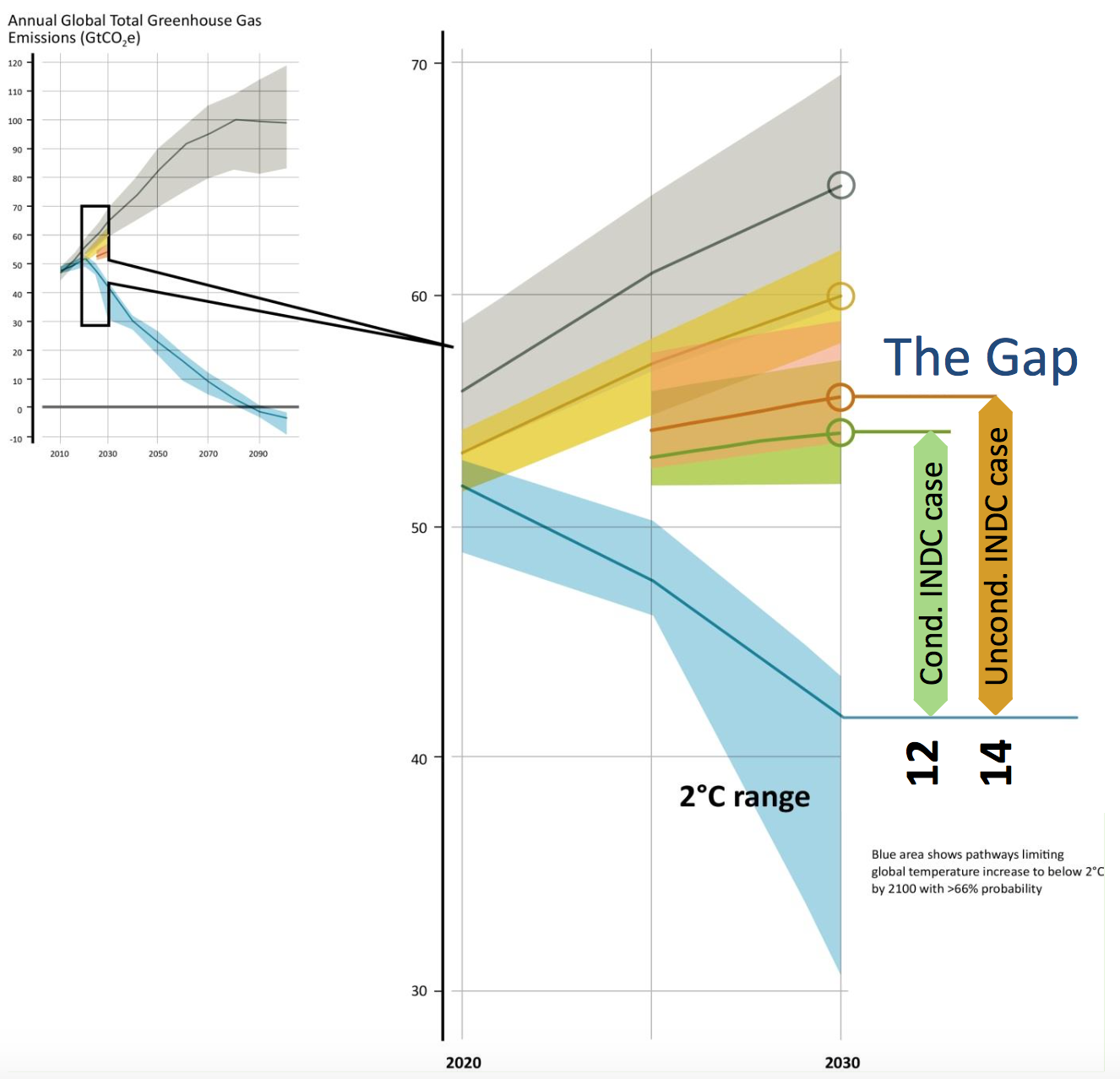

The “Intended National Determined Contributions” (INDCs) that nations pledged to in Paris, if they are actually delivered, only get us about halfway to the 2°C target. In the figure below, the gray space is business as usual. The yellow space is business as usual assuming all of the policy ambitions (pre-Paris) are fully executed. The blue space represents the emissions trajectory necessary to meet the 2°C warming target.

Source: United Nations Environment Programme.

According to calculations from the United Nations Environment Programme, full implementation of unconditional INDCs means a 66% chance that global warming will range between 3°C and 4°C by 2100. Full implementation of unconditional and conditional INDCs (for the most part, those conditional on aid from developed nations) limits warming to between 3°C and 3.5°C by 2100.

Those INDC promises, however, are hard to believe. Developing nations estimate that the cost of meeting their conditional and unconditional commitments totals about $3.5 trillion, $2.5 trillion in India alone. There is little prospect that the developed world will come up with the promised $100 billion per year of assistance they pledged to the lesser development nations preparing to sign the agreement. Even if they did, it is unclear whether the developing world will actually make good on such ambitious commitments (many of which were so vague and imprecise that it’s hard to know exactly what those INDCs would entail). Enforcement, according to the Paris treaty, is to be “facilitative in nature and function in a manner that is transparent, non-adversarial and non-punitive” and will “pay particular attention to the respective national capabilities and circumstances of Parties.” Good luck with that.

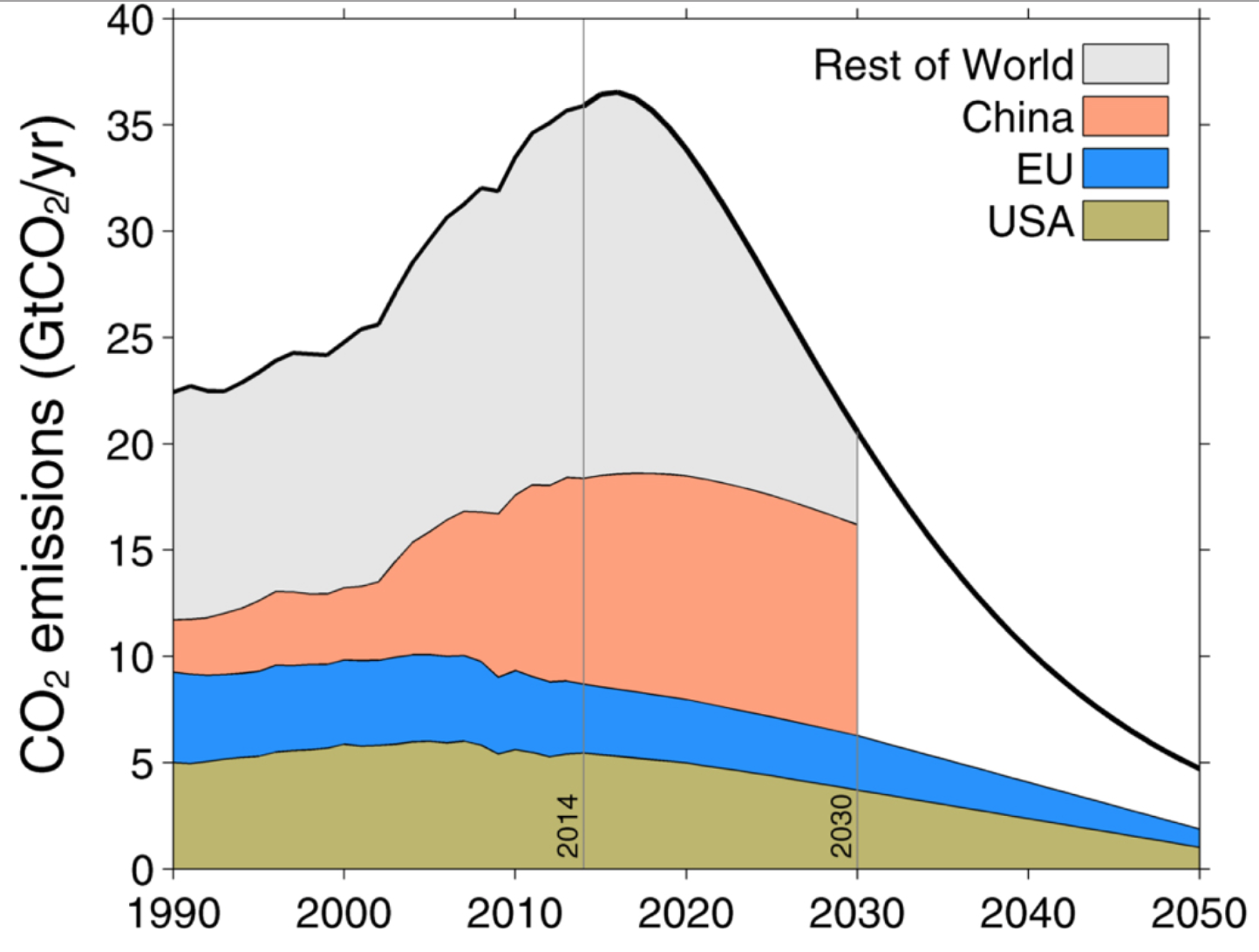

Even if the developing world hits its unconditional and conditional INDC pledges, the INDC pledges from the developed world make emissions reductions required to hit the 2°C warming goal impossible. Consider the combined emissions from just three sources (China, the European Union, and the United States) compared to global emissions, with the thick solid line representing a global pathway consistent with holding the planet to 2°C warming.

Source: Peters et al, 2015.

The best illustration of what is required to meet the 2°C warming goal is that a third of total global oil reserves, half of global gas reserves, and over 80 percent of current global coal reserves must remain unused to meet the target. And that means no additional development of unconventional oil fields or the newly discovered fields in the Arctic (now exploitable, by the way, thanks to warming). The 2°C warming goal otherwise assumes that we invent economically affordable technology (such as this, now only in very early development) to remove CO2 from the atmosphere at a massive scale.

The prospects for future global agreements to achieve these emissions reductions are dim. Consider what would be required of the United State in a “fair” agreement: one that would cap per capita emissions evenly across nations. That agreement would require the United States to eliminate all greenhouse gas emissions within 25 years. An agreement that required the same percentage of emission reductions across nations would, on the other hand, require the United States to reduce greenhouse gas emissions by 80 percent over that same 25 year period. I can’t imagine the United States meeting either commitment given the policy path we’re on or the political remedies that have been offered (and rejected) thus far.

Finally, all this assumes that the “carbon budgets” that drive many of these scenarios about what’s required to prevent warming from exceeding 2°C are accurate. But new research suggests that even those budgets may be inflated and in need of downward adjustment.

What to Do?

First, we need to give up on the hope that a global emissions agreement involving enforceable emissions caps will ever be produced at U.N. events like the those conducted in Berlin (1995), Geneva (1996), Kyoto (1997), Buenos Aires (1998), Bonn (1999), The Hague (2000), Bonn (2001), Marrakech (2002), Delhi (2002), Milan (2003), Buenos Aires (2004), Montreal (2005), Nairobi (2006), Bali (2007), Poznan (2008), Copenhagen (2009), Cancun (2010), Durban (2011), Doha (2012), Warsaw (2013), Lima (2014), Paris (2015), or next year in Marrakech. Twenty-four meetings over 21 years have yet to produce anything of real consequence. The problem is not that negotiators are not trying hard enough. The problem is that, as pointed out in a number of excellent essays in a recent special issue of Economics of Energy & Environmental Policy (be sure to navigate to vol. 4, no. 2), there are too many difficulties associated with producing national emissions quotas and too many incentives for countries to cheat on commitments.

Second, we should frankly acknowledge the distance between existing policy and the task before us. If we are serious about reducing the risks associated with global warming, we shouldn’t kid ourselves that market forces, uninhibited by much steeper explicit or implicit prices of greenhouse gas emissions, will deliver us from significant climate risks. Or that major increases in the use of natural gas, say, in lieu of coal, is a substitute for aggressive mitigation. Nor should we kid ourselves about the emissions reductions likely to be produced by the potpourri of existing U.S. policies. Nor is renewable energy likely to save the day, no matter how heroic our growth assumptions, without radical policy intervention. To keep warming from exceeding 2°C, renewables worldwide would have to grow from 9% of total energy supply to 50% by 2028—an energy transition light-years beyond anything we’ve seen in economic history. Inventing our way out of the climate problem via energy technology breakthroughs would be wonderful, but it’s not as if billions aren’t being spent already on exactly that, and the time it will take for new energy technologies to migrate into the economy will take many decades (far more time than we have if we wish to get anywhere close to a 2°C warming target).

Third, we need to pursue dramatic emissions reductions now. The least costly means of achieving those emissions reductions is to put a stiff price on carbon and let market actors decide when, where, and how reducing emissions makes the most economic sense. The most effective way to promote international action to do the same is impose a joint carbon tax with like-minded nations and tax imports for carbon content as if they were produced within the nations that are party to the agreement. And the most attractive means of reducing the economic impact on energy consumers is to rebate carbon tax payments in some fashion back to the American people.

How high would a U.S. carbon tax have to be to reduce U.S. emissions by 80% in 2050 (our share of the global emissions reductions that would have to follow were all nations on earth required to reduce greenhouse gas emissions at the same rate)? Given the extreme difficulty associated with predicting the future course of the economy as a whole and how that economy would respond to a carbon tax, it is surprisingly hard to say. According to seven modeling runs performed by the Stanford Energy Modeling Forum (EMF-24), we would likely need a $65 per ton tax in 2020 (plus or minus $40 per ton), rising to $439 per ton in 2050 (plus or minus $228 per ton). Those high tax rates for 2050, however, are largely driven by one of the models that projected a major spike in carbon taxes in 2050 to nearly $900 per ton. If we throw that model out, the carbon tax required in 2050 to meet our target is between $135 per ton and $593 per ton. In 2045, with that model out of the mix, the mean tax required is $296 per ton (plus or minus $108 per ton).

The (very large) error bars associated with the emissions reductions that would follow from a carbon tax is largely a reflection of whether we are optimistic or pessimistic about the prospects for low carbon energy. If wind, solar, nuclear, carbon capture and storage technology (CCS), electric vehicle technologies, and energy efficiency (the really big kahuna according to the modeling) will become as competitive with fossil fuels as proponents believe, then the emissions reductions that follow from a carbon tax will be on the high end of the Stanford modeling forecasts and the corresponding taxes needed to achieve emission reductions will, correspondingly, be on the low end. If low carbon energy, CCS, and energy efficiency proves to be less economically competitive with fossil fuels than proponents believe, then the carbon taxes required to meet our target will be on the high end of the Stanford forecasts.

The Implications of Ambition

Some environmentalists understand full well the need for dramatic action and are skeptical that politicians will ever deliver a carbon tax that will yield the emissions reductions required to prevent us from playing a risky game of dice over the planet’s future. That’s why they support simple, heavy-handed government responses like prohibitions on future oil, gas, and coal development, the “Keep It In the Ground” campaign, and direct government orders to cap the amount of fossil fuels that can be used in the economy. They are right to be skeptical. But if politicians lack the will to impose economic costs via a carbon tax, what makes us think they have the will to impose draconian, heavy-handed interventions that will cost the economy even more than will a direct tax?

Some conservatives likewise appreciate the implications of a policy that would prevent warming from exceeding 2°C and conclude that, if the climate problem is as serious as mainstream climate scientists believe, then there’s little we can do beyond “going Amish” (a line I used to use to great effect years ago when I was on the other side of this debate), and there they will not go. That likely explains, in part, why so many environmentalists play-down the scale of the economic changes necessary to avoid dangerous climate risks.

But a low carbon energy world is not so unimaginable from a conservative perspective. First, conservatives believe as a matter of faith that nuclear power is a low-cost energy source held hostage by irrational environmental fears. While I don’t buy that narrative, the fact remains that seventy five percent of France’s electricity generation comes from nuclear power. The French economy does not seem unduly constrained by its reliance on nuclear energy. “Going nuclear” will be costly, but experience abroad suggests that its costs are, broadly speaking, manageable. The fact that a growing number of influential environmentalists are rallying around nuclear power (consider, for instance, this rather sensible pro-nuke essay last year in, of all places, Mother Jones) suggests that this might be politically manageable as well. Given that electric cars are viable today and innovations will likely significantly improve cost and performance, one can easily imagine a nuclear future across all energy markets.

Second, conservatives and libertarians too often forget the arguments forwarded by the late Julian Simon—a patron saint on the Right (and former colleague of mine at Cato)—in the course of these discussions. The gist of Simon’s argument is that necessity is the mother of invention. When natural resources become scarce (and thus, expensive), history demonstrates that the innovative engines of the human mind will discover (or more precisely, invent) new resources and technologies to displace the old. Moreover, these new resources and technologies have invariably outperformed the old in terms of both both price and quality. If Simon is right (and I think that he is), then the fossil fuel scarcities and high prices delivered by a carbon tax will unleash the same engines of human innovation that they have unleashed in other contexts.

Be that as it may, it is difficult to imagine the political class embracing a carbon tax steep enough to keep global temperatures from exceeding 2°C. The more emissions reduction we can achieve, however, the lower climate risks will be. Hence, we should:

- Embrace the largest carbon tax that political conditions will allow;

- Invest smartly in clean energy R&D;

- Brace for the fact that—whether we like it or not—dice will be played regarding the future of the planet;

- Invest in adaptation; and

- Investigate geoengineering technologies we may very well need to address the climate risks that we’re inviting by lack of mitigation.

If one accepts mainstream science, that is the most logical and least costly path for us to follow.