With the growing support for a child allowance on both sides of the aisle, the Center on Poverty and Social Policy at Columbia University has published a new research brief estimating the full costs and benefits of President Biden’s proposed Child Tax Credit expansion. The topline finding: the benefits created by a child allowance could be worth eight times the annual program cost.

The team centered their analysis on the Biden proposal to expand the Child Tax Credit (CTC) as part of the forthcoming Covid-19 relief package. The reforms would increase the CTC to $3,600 for children aged 0 to 5, and $3,000 for those aged 6 to 17. Payments would be issued monthly or quarterly depending on the IRS’s capabilities, and by being fully-refundable, any phase-in or minimum income requirements to qualify would be eliminated. The proposal mirrors the American Family Act, legislation that the Niskanen Center has previously analyzed here.

While previous studies have estimated Biden’s proposed CTC expansion’s direct poverty impact, this new analysis is the first to provide a rigorous cost-benefit analysis. It finds that the Biden CTC would initially cost approximately $100 billion per year, with 60 percent of the new spending going to families making less than $50,000 per year. The expanded CTC begins phasing out at incomes above $75,000 for single filers and $100,000 for married filers, and only 18 percent of the increased child benefits would go to families with earnings above $100,000 per year. The authors argue that this distribution of benefits is justified by research suggesting that equivalent increases in family income improve low-income household outcomes more than higher-income families that are already well-resourced.

To establish the causal impacts of increased child benefits, the group conducted a review of previous studies on existing cash or near-cash transfer programs. They found significant impacts in these types of programs on a plethora of variables, ranging from improved health and wellbeing for parents and children alike, to increases in child beneficiaries’ future earnings when they become an adult.

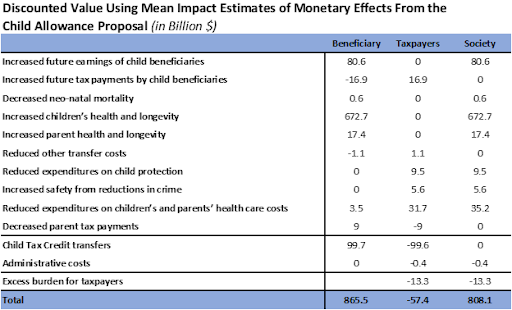

Using mean impact estimates, the team applied these effects to the Biden CTC proposal, and found that the $100 billion per year initial expenses would be offset by $865 billion in annual monetary and non-monetary benefits. Taxpayer costs would even be driven down from reductions in family health care expenditures and decreased usage of child protective or criminal legal services. What is most striking is that a vast majority of the benefit — over $670 billion — stemmed from improvements to children’s health and longevity. For comparison, the second-largest economic benefits source is an estimated $80 billion per year from the increased future earnings of the children of recipients.

The researchers conducted a sensitivity analysis to gauge the amount of uncertainty in the estimates of how beneficial the proposed child allowance would be. While there was a wide range of estimates, they concluded that “most plausible estimates range from AFA being a very good to extraordinarily good investment in our Nation’s future.”

To have a negative impact estimate at all, the team had to combine several extreme assumptions. Among other restrictions, these included estimating the value of life and a qualify-adjusted year of life at a 1/10th of the normal CBO value, assuming a discount rate of 5 percent instead of 3 percent, and reduced returns in additional income for families receiving the benefit.

But even when using the most restrictive assumptions, while keeping a regular CBO value of health and applying a 1 percent discount rate — neither unrealistic estimates — societal benefits would still yield a net-positive $431.3 billion per year. Using combinations of less restrictive assumptions showed either $2.6 or $2.9 trillion in long-term societal benefits, including up to $200 billion in taxpayer savings. These results underscore the case for expanding child benefits and converting their current tax credit structure into an allowance. As previous research from Columbia’s Center on Poverty and Social Policy found, the American Family Act could reduce child poverty by almost 50 percent.

As policymakers consider which social programs to expand, research like this demonstrates the power of programs that directly boost family incomes. At this point, the case for a child allowance from both a social and economic perspective couldn’t be clearer.