Although unemployment insurance (UI) reform was conspicuously missing from the Build Back Better Act, states do not need to wait for federal action to improve their respective UI plans. As state policymakers prepare for the 2022 legislative session, they should pass laws to take full advantage of the Extended Benefits (EB) program.

Extended Benefits are automatic extensions to regular unemployment insurance, which activate when state unemployment levels are high. These additional weeks of benefits (up to 13 or 20 additional weeks) can be crucial for workers. During recessions, fewer jobs are available for many unemployed people, and the average duration of unemployment increases. Without longer-lasting benefits, workers can lose wage support before jobs rebound. EB programs are designed to deliver that support, although their impact across states varies.

At first glance, it appears EB programs have been effective over the last two years. They kicked in at the beginning of the downturn and shut down as each state’s economy continued to recover. In 2020, all states except South Dakota had these additional weeks of UI eligibility switch on. Twenty-four states still had active programs at the start of 2021. Now it is down to two. But this assessment overlooks a fundamental question: do the criteria to turn on and shut off these programs align with when workers need additional weeks of benefits?

The temporary federal pandemic unemployment programs enacted by Congress worked so well that long-standing issues with EB, specifically untimely deactivations, were missed. While Extended Benefit weeks are required by federal law when unemployment levels meet the necessary threshold(s), the federal government extends flexibility to states over the activation measures utilized. The mechanism by which EB turns on can incorporate several different metrics, and two of them are especially consequential. Specifically, every state must apply the Insured Unemployment Rate (IUR) for EB activation. Still, the Total Unemployment Rate (TUR) – a more comprehensive measure of an entire state’s workforce – is an optional alternative trigger that a state must proactively adopt. The Insured Unemployment Rate is especially limited as it only calculates the unemployment rate based on the number of workers receiving regular state benefits. This underestimates economic conditions because of generally low state UI recipiency and the short duration of UI benefits. States that use either metric to trigger on EB can better support long-term unemployed workers.

Yet, not all states have passed legislation that enables them to take advantage of the additional TUR trigger. Among the states that added the activation measure, some limit its application to situations where the federal government covers 100% of the necessary funding. Critically, only twelve states have passed legislation taking advantage of the TUR trigger and 50 percent reimbursement permanently available to any state that experiences a high unemployment rate. As a result, EB programs can turn off at high unemployment rates prematurely when the TUR metric could have kept them active, sometimes for months longer. State policymakers should make it their mission for states to permanently utilize both metrics (IUR and TUR) at all times, so the fate of their long-term unemployed workers is not left to the whim of Congress.

Pandemic performance by the numbers

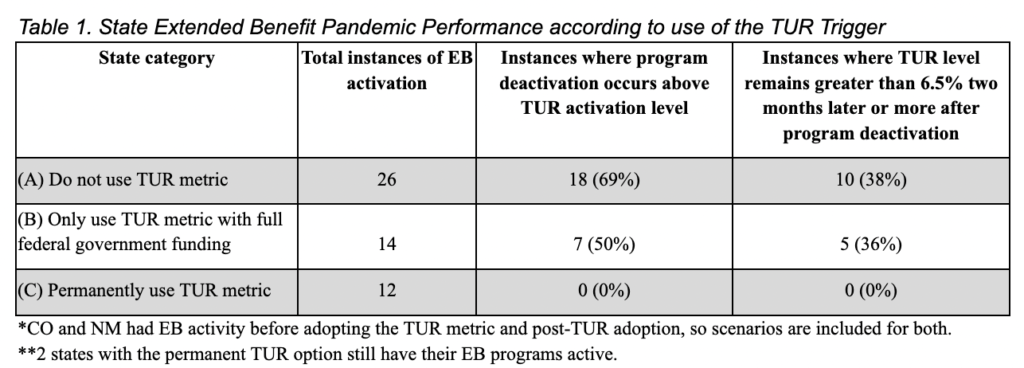

To understand how EB programs performed during the COVID-19 pandemic, Department of Labor Trigger Notices were analyzed between March 2020 and January 2022. Table 1 breaks participating states into three groups:

- States which do not utilize TUR

- States which utilize TUR, as long as the federal government covers 100 percent of the costs

- States that permanently utilize TUR, even when the federal government does not fully cover the costs

Among the states that did not use the TUR trigger, eighteen EB programs shut down sooner than was necessary. The average three-month total unemployment rate at the time of deactivation was 7.7% among those states – significantly higher than the 6.5 percent threshold. In other words, if they had been utilizing the TUR metric, the programs would have stayed active for longer.

States that only invoke the TUR metric when fully paid for by the federal government experienced similar outcomes. When Labor Day arrived and the American Rescue Plan unemployment insurance provisions ended, EB programs in some of the largest states, including California, Illinois, and New York, ended even when the state TUR exceeded 6.5 percent. The result was hundreds of thousands of EB-eligible workers missing out on additional weeks of coverage. For example, when temporary pandemic programs ended in September 2021 amidst the Delta wave, New Jersey (TUR of 7.2 percent) could pay benefits to over 100,000 long-term unemployed. Meanwhile, benefits in neighboring New York (unemployment rate of 7.7 percent) were cut off for more than 650,000 workers.

According to the Department of Labor reports, over a dozen states with shutdowns of EB had TUR levels above the necessary activation level over two months after the shut-off. States without the TUR trigger in their laws were the primary contributor to this category, but not alone. Of the six states with program shut-offs around Labor Day, five could have kept their programs active another two months or more if they did not require full federal funding.

This is a national issue. Without the temporary federal expansions, long-term unemployed workers across the country are not guaranteed supplemental weeks of UI in poor economic conditions. The economy should have a set of automatic stabilizers that it can count on regardless of competing concerns in Congress. That is the stated purpose of Extended Benefits, but the programs frequently fall short. If major overhauls to UI are politically impossible, Extended Benefit reform is a valuable place to start.

Photo Credit: iStock