Key Takeaways

- The Stemming Warming and Augmenting Pay (SWAP) Act would levy a tax on greenhouse gas (GHG) emissions from fossil fuels, certain large industrial facilities, and certain products, while reducing the tax rate of the payroll tax.

- The GHG tax would start at $30 per metric ton of CO2-equivalent emissions and increase at a real rate of 5 percent per year. Modeling estimates indicate that in the first 10 years, the SWAP Act reduces taxed GHG emissions by about 40 percent against 2005 baseline levels and raises over $1.2 trillion.

- Seventy percent of revenue from the SWAP Act would go toward reducing the payroll tax for employees and employers, with the remainder going toward climate adaptation, energy research and development, and measures to mitigate the impacts of the tax for the poor and retired.

- The SWAP Act amends the Clean Air Act to impose a rolling moratorium on EPA regulation of GHG emissions from stationary sources as long as emissions are below specific targets for 2021-2029.

Introduction

The SWAP Act was introduced by Rep. Francis Rooney (R-FL) and Dan Lipinksi (D-IL) on July 25, 2019. The legislation would levy a tax on GHG emissions, i.e., a carbon tax, and uses a majority of the revenue raised to reduce the rate of the payroll tax, while funding R&D for clean energy, and protecting the poor and elderly from increased costs.

The SWAP Act will 1) fund a payroll tax reduction by taxing GHG pollution; 2) spur significant reductions in GHG emissions; 3) and offer a market alternative to the expansion of federal GHG regulations.

Tax Swap Details

The SWAP Act levies a tax on GHG emissions from fossil fuel combustion, industrial processes, and product uses, and uses the revenue generated to reduce the payroll tax rate. While it is convenient to refer to this as a carbon tax, the SWAP Act applies the tax to emissions of multiple GHGs (CO2, methane [CH4], nitrous oxide [N2O], and ozone depleting F-gases [HFCs, unless the United States joins an international agreement regulating HFCs separately) based on their CO2-equivalent warming potential measured over 100 years.

The SWAP Act reduces the payroll tax rate, which is currently 12.4 percent.[i]The payroll tax provides revenue for the Social Security Trust Fund, which provides benefits to retired workers, their families, and survivors of deceased workers through the Old-Age and Survivors Insurance program; it also provides benefits to some people with disabilities and their families through the Disability Insurance program.

How much?

The tax is levied at a rate of $30 per metric ton of CO2-equivalent (CO2e) emissions, starting in 2021. The rate increases 5 percent annually in real terms using the Consumer Price Index to adjust for inflation. If the carbon tax is first collected in 2021, then over the first 10 years the rate would average $46.54 per ton in 2020dollars. After 2030, the tax continues to increase annually at 5 percent real.

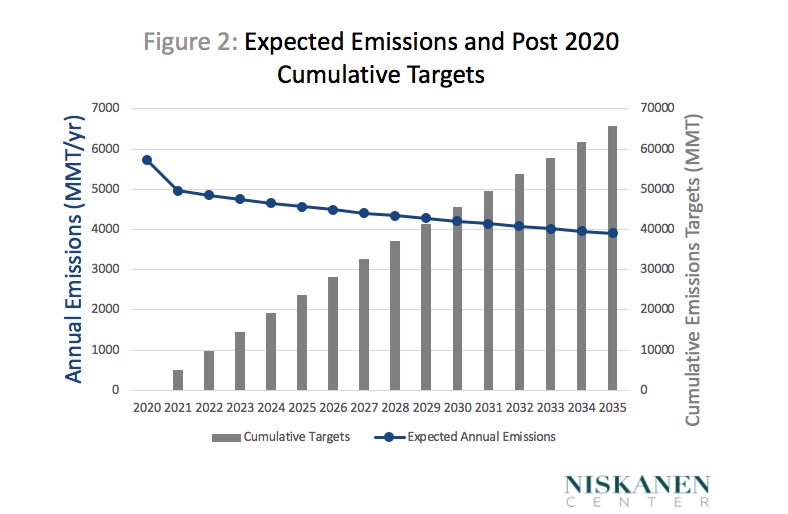

The SWAP Act includes mechanisms to adjust the carbon price to meet a series of emissions targets, such that if emissions reductions fall behind expectations set in the legislation, the rate of the carbon tax will increase automatically. The targeted emissions reductions are expressed as annualized cumulative emissions from taxed sources, but expect a decreasing emissions rate. If taxed emissions are higher than targeted levels, then the rate of the carbon tax will increase. Every two years, the EPA administrator and the secretary of the Treasury must report emissions levels under the tax for the preceding year and issue a finding as to whether or not they exceed the specified targets. If they do, then the tax will automatically increase an additional $3 per ton the following year, on top of the annual 5 percent increase. If emissions are less responsive to the carbon price than the sponsors expect, these adjustments could occur a maximum of five times over the first 11 years of the tax, potentially increasing the tax rate by up to $15 per ton. After 2031, there are no emission targets and thus no provision for such increases.

Who pays?

The SWAP Act carbon tax affects fossil fuel emissions and select industrial and product emissions, covering about 85 percent of U.S. GHG emissions. Table 1 shows estimates of the taxed emissions from these different sources.

| Table 1: U.S. Greenhouse Gas Emissions Coverage | |||

| Source | 2016 emissions (mmt CO2e) | Percentage of total 2016 U.S. emissions | |

| Total | 5590a | 85 | |

| Fossil Fuels | 5078b | 75 | |

| Industrial Processes | 220 | 3.4 | |

| Product Uses | 421 | 6.2 | |

| a. Does not include ethanol or biomass emissions. b. Includes 112 MMT of non-combustion emissionsData from U.S. EPA Greenhouse Gas Inventory 2018, see Appendix 1 for detailed totals. |

Fossil Fuels: The largest part of the tax base is fossil fuel emissions. The SWAP Act taxes coal, petroleum fuels, and natural gas produced in, or imported into, the United States based on GHG emissions during the fuels combustion. The owner of the fossil fuel at the point of taxation is responsible for paying the tax. The proposal requires the secretary of the Treasury and EPA administrator to issue rules defining how combustion emissions will be calculated for different fossil fuel products.

This tax is designed to minimize the number of taxed entities. Coal is taxed at the mine mouth; petroleum products are taxed at the refinery exit; and natural gas is taxed at the exit from the gas processing plant. Imported fossil fuels are taxed at the point where they first enter the United States. For cases not captured by these categories, the point of taxation is selected to reasonably limit the number of entities paying the tax.

In addition, the carbon price covers certain non-fossil sources of emissions that result from industrial processes and product uses.

Process Emissions: The SWAP act imposes the same rate of tax on emissions from facilities that emit GHGs while manufacturing a specific list of products such as metals, petrochemicals, and cement. Facilities emitting more than 25,000 metric tons CO2e per year in process emissions are taxed on those emissions. EPA may add to the list of taxed facilities when total emissions from a previously exempt source category are over 250,000 metric tons per year for 2 out of the previous five years, average facility emissions are over 25,000 metric tons for those years, and EPA anticipates that source category emissions will be over 250,000 metric tons in any of the following five years. EPA may remove source categories when total source category emissions fall below 250,000 metric tons per year for three consecutive years and are expected to remain below that level, and facility emissions have averaged less than 25,000 metric tons per year during that period.

Product Use:The SWAP Act also imposes the same tax rate on emissions from specific products that release GHGs when used, including fuel ethanol, biodiesel, and woody biomass. The list of covered products includes HFCs and other ozone-depleting substances, as long as the United States has not ratified the Kigali Amendment, which would regulate these emissions in accordance with the Montreal Protocol. Product manufacturers (or importers) are responsible for paying the tax. For biofuels, the tax rate is based on the lifecycle emissions of the product. As with industrial process emissions, EPA can add to, and must remove from, the list of products when certain emissions criteria are met.

Rebates and border adjustments

The SWAP Act creates a rebate for fuel purchasers who use fossil fuels as raw materials for durable products (preventing some emissions) or who capture CO2 from combustion and sequester it in geological storage. However, there are no rebates for sequestration until Treasury issues regulations defining secure geological storage and sequestered CO2 that has been credited under the 45Q tax credit for carbon capture is not eligible for an exemption.

The proposal also offers a declining credit against any carbon price paid at the state level, as in California or the RGGI states. In the first year of the carbon tax, anyone who pays a state-based carbon price can apply for a credit against the federal price equal to the full state-based tax. In the second year, they may apply for a credit equal to 80 percent of the state-based price. The credit falls another 20 percent each year, reaching zero in the sixth year and beyond.

The declining credit gives those states that price CO2 emissions time to decide whether to modify the scope or rates for their pricing schemes. Not allowing any credit would not give states that opportunity; on the other hand, a permanent 100 percent credit would encourage every state to impose their own carbon tax, which would undermine the revenue purposes of the SWAP Act.

Like many previous carbon tax proposals, the SWAP Act also authorizes the Treasury Department to create border adjustments for greenhouse-gas-intensive goods. Border adjustments require importers of carbon-intensive goods to pay a fee based on the average tax paid by manufacturers of comparable products in the United States, to maintain the competitiveness of domestic producers of greenhouse-gas-intensive and trade-exposed goods and prevent leakage of industrial emissions. Importers of highly-traded goods that have a GHG intensity (calculated as emissions multiplied by the carbon price) higher than 5 percent of the total market value of their good are subject to these border adjustments. Likewise, exporters of those same goods will receive rebates, to maintain their competitiveness in international markets.

The president is also given the authority to exempt sectors or products if subjecting them to the adjustment were not in the interest of the United States. The bill also exempts from the tax products that come from the least-developed countries, or countries the president determines have minimal GHG emissions.

Greenhouse Gas Emissions and Revenue Disbursement

Revenues from the SWAP Act will depend on future GHG emissions and changes in fossil fuel usage, which is expected to decline under the new carbon tax, as emitters and consumers adopt lower-emitting alternatives. Thus, estimates of SWAP Act revenue must take the emitters’ expected response into account.

Expected emissions

The SWAP Act carbon tax is expected to significantly reduce GHG emissions, but not enough to eliminate them as a source of revenue in the 10-year period after the tax is first imposed. As they are the largest emissions category covered by the tax, emissions from fossil fuel combustion are the most important to projections of revenue and environmental outcomes. We expect these emissions, especially from the electric power sector, to be the most responsive to the carbon price.

Using the Goulder-Hafstead E3 model, a CGE (Computable General Equilibrium) model of the U.S. economy, economists at Resources for the Future have projected how the tax swap would affect GHG emissions.[ii] For a carbon tax starting at $30 per ton in 2021 and increasing 5 percent annually in real terms, the model projects that CO2 emissions from fossil fuel combustion will fall 41 percent from 2005 levels by 2030 (starting from 15 percent below 2005 levels in 2020). In the power sector, the model projections indicate that emissions will fall 66 percent from the 2005 levels.

To fully account for the tax’s revenue and GHG emissions impacts, emissions from other source categories should be included. However, the emissions response to the tax in those other sectors is not as readily modeled. The simplest approach is to assume that those emissions remain constant at their 2016 levels near 766 million metric tons per year. This leads to a conservative estimate of the environmental benefits of the bill, and a generous estimate of the revenue.

Expected emissions from the taxed sources can be generated by adding the fossil fuel combustion emissions from the E3 model with the static emissions assumed from other sources. We report that sum for the first decade of taxation in Table 2.

Expected revenue

The revenue values in Table 2 reflect the new revenue expected after a 25 percent haircut, as an approximation of the Congressional Budget Office practice for new excise taxes. After this adjustment, revenues generated by the SWAP Act would be over $1.2 trillion over the first 10 years of the tax.

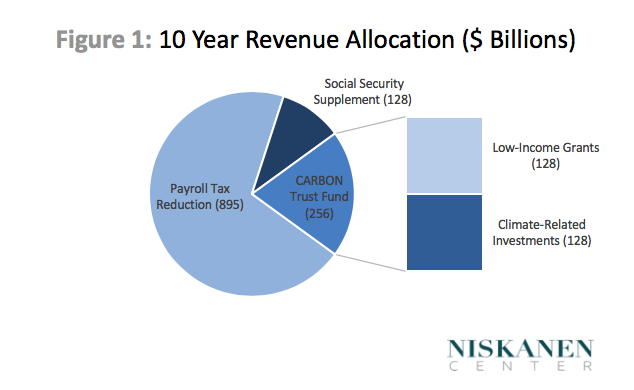

The SWAP Act appropriates specific percentages of the revenue generated for funding a payroll tax rate reduction, protecting Social Security beneficiaries from higher energy prices, and the establishment of a CARBON Trust Fund, where revenue will be used for energy assistance to low-income households, climate adaptation, and advanced energy R&D. Figure 1 shows how those revenues would be distributed under the SWAP Act.

| Table 2: Expected GHG Emissions and Revenue (2020 dollars) | |||

| Year | Carbon Price ($) | Expected Emissions (MMT) | Net Revenue (billion $) |

| 2015 | – | 6343 | – |

| 2016 | – | 5590 | – |

| 2020 | – | 5733 | – |

| 2021 | 30.00 | 4959 | 112 |

| 2022 | 31.50 | 4857 | 115 |

| 2023 | 33.08 | 4754 | 118 |

| 2024 | 34.73 | 4659 | 121 |

| 2025 | 36.47 | 4573 | 125 |

| 2026 | 38.29 | 4491 | 129 |

| 2027 | 40.20 | 4409 | 133 |

| 2028 | 42.21 | 4342 | 137 |

| 2029 | 44.32 | 4278 | 142 |

| 2030 | 46.54 | 4210 | 147 |

| 10-YR Total | 45533 | 1279 | |

| 1 Expected Net Revenues after 25 percent haircut. |

Payroll Tax Rate Reduction: 70 percent of the net revenue raised by the SWAP Act will go towards reducing the payroll tax rate. This will allow for an estimated reduction of about 1 percent across employee and employer payroll tax rates, which is the rate cut in the first year. Thereafter, the Secretary of the Treasury will calculate a reduced rate for each year based on the ratio of expected carbon tax revenue and payroll tax receipts. The payroll tax rate is reduced by that ratio to keep revenue into the Social Security Trust Fund consistent with present day policy and would eventually restore the full payroll tax rate as carbon tax revenue decreased to zero. Treasury can make changes to the reduced rate to adjust for shortfalls or surpluses in revenue from the previous year. An additional 10 percent of net carbon tax revenue will be distributed to Social Security beneficiaries, who do not benefit from payroll tax rate reductions, to help offset some of costs associated with higher energy prices.

The CARBON Trust Fund: The remaining net revenue (20 percent) will go towards the establishment of the CARBON Trust Fund. 50 percent of the Fund will be made available for a state-based grant program that individual states will use to offset higher energy costs for low-income households.

The remaining 50 percent of funds available in the CARBON Trust fund will be appropriated for climate adaptation, carbon sequestration, energy efficiency, and advanced energy R&D programs.

Regulatory Moratorium

Starting from the time it is first collected, the SWAP Act imposes a conditional moratorium on EPA finalizing or enforcing regulations to limit GHG emissions from taxed sources.

Exceptions

EPA retains its full authority over GHG emissions from natural gas and petroleum systems and from publicly-owned sewage treatment plants. EPA also retains its full authority to limit GHG emissions from motor vehicles, nonroad engines, and aircraft, although the latter may not be stricter than the limits imposed by the International Civil Aviation Organization.

Beyond reducing GHG emissions, EPA retains (1) all other regulatory authority over GHG emissions (e.g., monitoring and reporting requirements, information gathering); (2) authority to regulate GHG emissions for non-GHG effects; and (3) authority to regulate any GHG that is not among the six specific ones targeted by the bill (carbon dioxide, methane, nitrous oxide, HFCs, PFCs, and sulfur hexafluoride).

Conditions

The regulatory moratorium imposed by the SWAP Act is conditional on GHG emissions-reductions from the taxed sources meeting the bill’s targets. Those targets are defined by the expected emissions in Table 2, but apply to cumulative emissions as of 2021 and 2029 (figure 2) from the taxed sources. In March 2026, cumulative emissions will be reported for the period 2021-2025; if those emissions are higher than the 2025 cumulative emissions target, then the regulatory moratorium will end in October 2026. Likewise, cumulative emissions through 2029, determined in March 2030, will determine if the moratorium will extend beyond October 2030. In any event, the regulatory moratorium expires on January 1, 2034.

Conclusion

The SWAP Act provides a novel source of revenue to reduce existing distortionary taxes with significant expected environmental benefits. As a GHG reduction measure, the SWAP Act differs from previous carbon tax proposals in key ways.

First, this proposal can be considered a tax swap, as a majority of the revenue is used to reduce the payroll tax rate. Secondly, this proposal is revenue positive. Under the SWAP Act, new revenue is dedicated to the CARBON Trust Funds to reduce the impact of the new carbon tax on poor households, support climate adaptation and support low-carbon energy research and development.

While the sponsors expect the proposal will spur significant reductions in GHG emissions, and propose a price adjustment mechanism to secure those reductions, the bill does not specify GHG emissions targets beyond 2031. This is a fundamental difference from climate bills that use carbon pricing to pursue midcentury climate goals. How well the price adjustment mechanisms will work and what information about long-term carbon pricing strategies would be captured by having a decade of carbon pricing to measure the economic and environmental outcomes of a meaningful carbon price are questions for further study.

[i]U.S. Congressional Budget Office, The Budget and Economic Outlook: 2019-2029, (CBO: Jan. 2019)https://www.cbo.gov/system/files?file=2019-01/54918-Outlook.pdf

[ii] Marc Hafstead, Carbon Pricing Calculator (Resources for the Future: September 2019), https://www.rff.org/cpc/

Photo Credit: NASA ICE under CC BY 2.0.