The work incentive created by the Earned Income Tax Credit has been the subject of extensive study for decades now, with generally positive results. The pro-work potential of the Child Tax Credit (CTC), in contrast, has been relatively ignored.

A new job market paper from Wei Zheng, a PhD candidate at the University of Connecticut, attempts to fill this gap in the literature. Using event study and simulation techniques, Zheng provides new and detailed estimates of the effect of the Child Tax Credit on maternal labor supply. The headline finding: a $1000 increase in the average CTC is associated with a 1.1 percentage point increase in labor force participation for single mothers.

The pro-work value of the CTC will be surprising to those who believe direct income support for families necessarily reduces the incentive to work, particularly without an explicit work requirement. Nonetheless, Zheng’s findings are consistent with previous research, both on the CTC and on unconditional transfers more generally. The traditional welfare system, Aid to Families with Dependent Children, was associated with non-work and dependency primarily due to the way benefits were clawed back with earnings, in some cases nearly dollar for dollar. “Income effects,” in contrast, refer to the work disincentives created purely by the lump-sum value of a benefit, and are known to be quite small.

Cash in hand

Zheng speculates that the pro-work effect of the CTC derives from its phase-in structure which, like the EITC, provides an implicit subsidy for earnings: for those in the CTC phase-in range, an additional $1 in earnings translates (post-credit) to $1.15 in total take-home income. An alternative possibility, however, is that the income effect of the CTC is actually positive at low levels of household earnings. This could arise given the severe liquidity and credit constraints facing very poor families, as illustrated by their greater reliance on “payday loans” and other expensive short-term lending options. A small amount of unconditional income support could thus relax those constraints, allowing a single mom to, for example, hire a babysitter while handing out resumes.

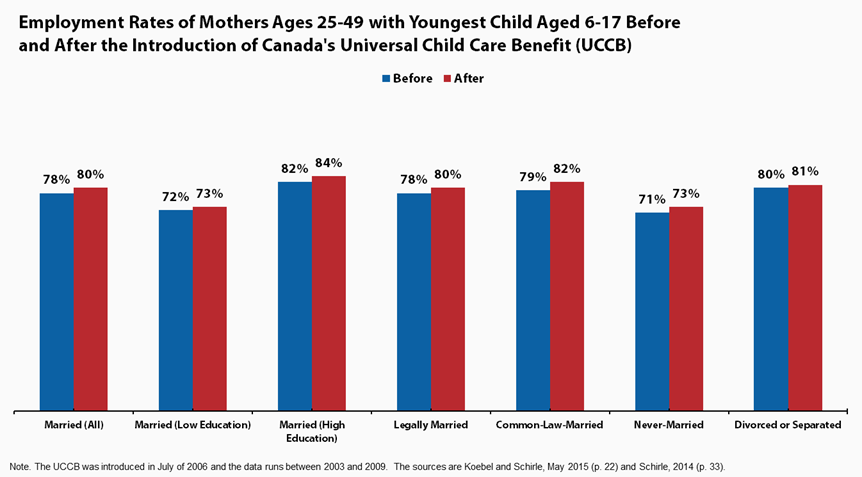

Canada’s child benefit provides support for this interpretation. As enacted in 2006, the $2000 per child benefit was universal and flat, meaning it had no phase-in. Nonetheless, a study of the program using a similar methodology found that unmarried mothers increased their employment by about two percentage points, consistent with Zheng’s estimates in the U.S. context.

According to Zheng’s findings, the CTC’s positive labor supply effect is driven by mothers whose youngest child is between 3 and 5 years old. This makes sense, as parents of preschool children are the most likely to face a clear tradeoff between working and staying home to care for their child. As such, Zheng finds that “every $1000 increase in average CTC decrease[s] the possibility of the children being taken care of by the parent by 5.29 percentage points.” More surprisingly, however, Zheng also finds that a $1000 increase in CTC leads to a 6.57 percentage points decrease in the use of day care centers.

How can the CTC both increase access to non-parental child care while reducing the use of formal day care centers? As Zheng goes on to show, a $1000 increase in the average CTC also contributes to a 13.4 percentage point increase in the probability of children being looked after by relatives. Family to the rescue.

As I have argued in the past, cash-based support for parents is vastly superior to subsidizing in-kind programs like day care. Subsidizing day care reduces parental choice while merely pushing up prices. The fungibility of a child benefit like the CTC, in contrast, allows parents to weigh the costs and benefits of different forms of child care (both formal and informal), and then choose the arrangement that works best for them. Surveys have long found parents of every income level favor home- and family-based child care to formal day care centers. Thanks to Zheng’s research, we can now see that preference revealed in the real behavior of low income moms.

This piece is part of our Captured Economy of Cost Disease series exploring the role of regressive regulation in driving-up the costs of core goods like health care, education, and housing. It is made possible thanks to the generous support of the Peter G. Peterson Foundation.