It is time for a serious discussion—on both the left and right—about whether nuclear power is part of the solution to climate change, and if not, what that means for public policy.

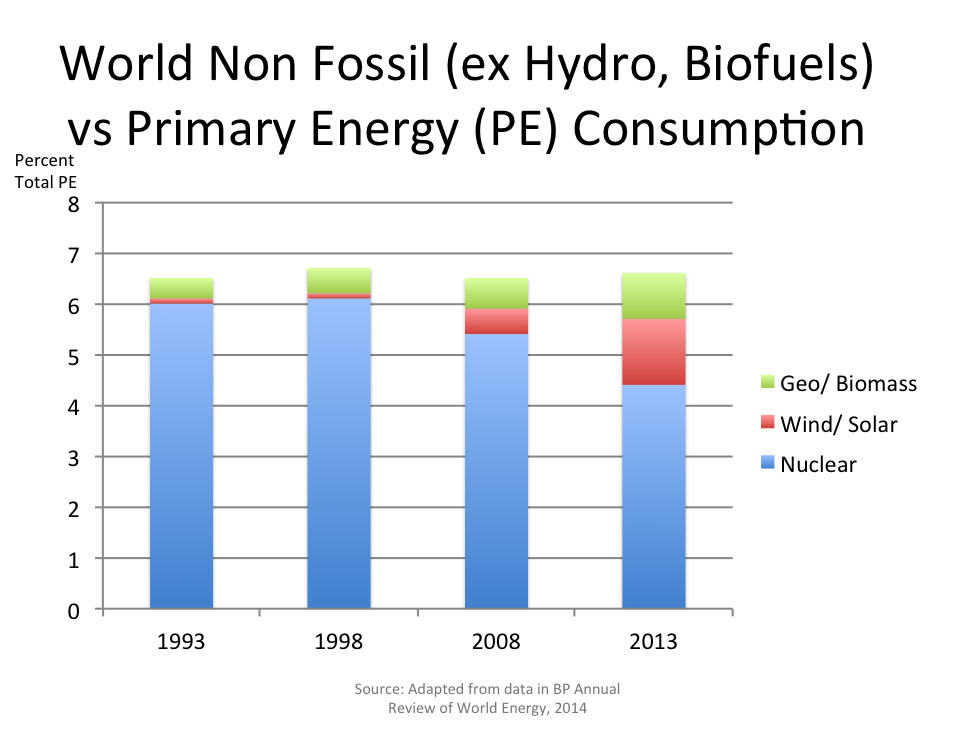

Consider the graph below, which is based on data from the BP Annual Statistical Review of World Energy for 2014 (EIA’s less detailed numbers tell the same story). Despite 20 years of effort to decarbonize energy use, “core” zero carbon energy’s share remains unchanged: geothermal, biomass, wind, solar, and nuclear were about 6.5% of total world energy use in 1993 and were still about 6.5% in 2013.[1] Because we’re thinking about how this share could grow, we excluded biofuels (little room to expand with more than 800 million people going hungry every day) and hydropower (very few places to build new dams). Including hydro would (thanks, Three Gorges) show some increase in zero carbon energy use, but there are very few, if any, such projects in our collective future.

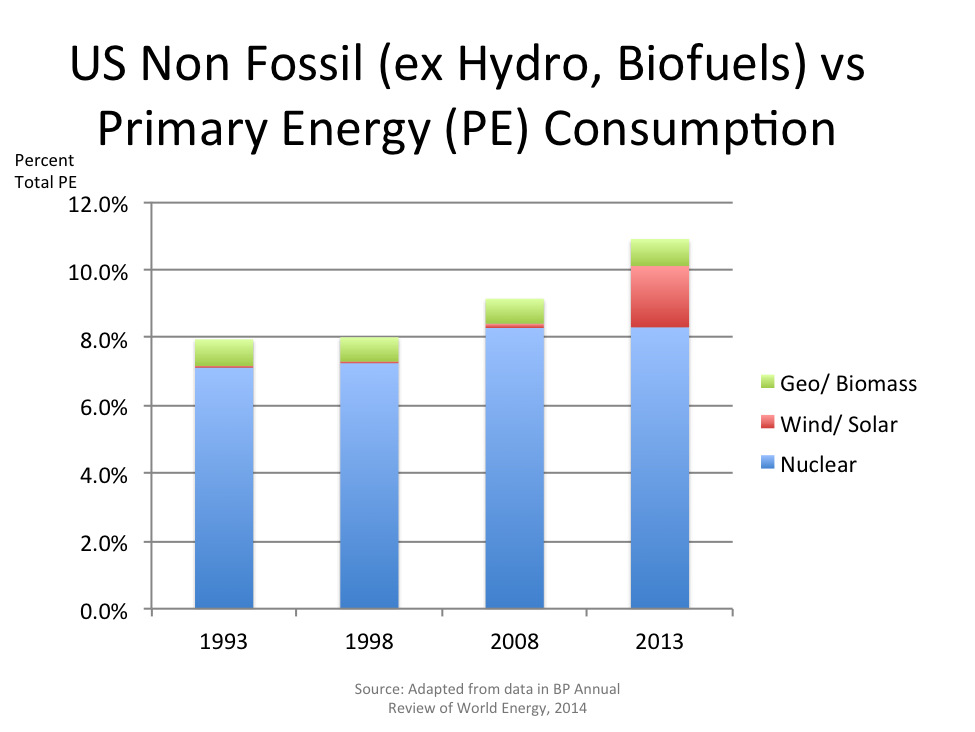

But, you say, what about the rapid growth of wind and solar we hear so much about? Well, yes, if you look at the same picture for the U.S. (below), wind and solar have been responsible for about two-thirds of the growth in U.S. zero carbon energy, from 8% of final consumption in 1993 to 11% in 2013, with nuclear making up most of the balance:

This matters, because the models suggest that climate change cannot be addressed globally without a substantially increased contribution from nuclear power. Modelers who have tried to envisage a completely non-nuclear approach have found that the task is harder and the costs are substantially increased.[2]

A significant part of the costs of phasing out coal and gas come in the form of stranded assets. Around the world, hundreds of billions of dollars have been spent to build coal and gas power plants, and those plants have many years of useful life left. However, we do not consider those costs here as they apply equally whether or not the future is renewables and Carbon Capture and Storage (CCS) or renewables and CCS plus nukes. But bear in mind that, regardless, someone (i.e., you, us, and everyone else) is going to have to eat those costs of building that capacity twice.

Wind. The good news is that, as EIA says, onshore wind is more often than not cost competitive with new coal, even including intermittency (and thus necessary backup) and the cost of new transmission infrastructure to get it from windswept places to urban consumers. Like the banks and most of the industry, EIA includes in their calculations a $15/ ton carbon price as a surrogate for the expected regulatory costs of building new fossil fuel capacity.

Solar. Enormous progress has been made, but even without factoring in intermittency, PV systems are still much more expensive than either coal or gas; a high price on carbon would help address that. Concentrated solar, even with a carbon price, is still hopelessly expensive.

Geothermal. The red-headed stepchild of the renewables group is, in EIA’s analysis, by far the most economically attractive for new capacity coming into operation in 2019 and has no intermittency problem, but, as EIA notes, this is a reflection of limited but very attractive capacity available. (Perhaps geothermal is just as much limited by lack of a good iconic image like a windmill or solar panel.) Ironically, the people who would seem to have the most relevant expertise to offer in developing this are the oil companies, but with the exception of Chevron, they have chosen not to play.

If we reach a point where the grid is capable of meeting demand via wind, solar, and geothermal by sheer number and geographic spread of such facilities and an unprecedented change in the availability and cost of mass storage, then we will certainly not need baseload coal, gas, or nukes. But that day is not anytime soon. All of which is a clear indication that renewables do not yet—or foreseeably—have the scope to fully replace fossil fuels. So, without a switch from baseload coal to baseload gas that would perhaps solve roughly half the electricity emissions problem—and which many environmentalists might find almost as tough to swallow—this brings us back to nuclear.

From a climate standpoint nuclear would seem to have a lot going for it. It’s carbon free, though emissions associated with fuel production, plant construction, and disposal can’t be ignored. Operating costs are low, and it is ideally suited for baseload, 24/7 generation (the role otherwise assumed today by coal) and for which today’s intermittent renewables are unsuited.

So nukes should in theory be part of the climate solution. But (and there is always a “but”) as we all know, nuclear has more than a few nasty issues.

Safety. Nuclear’s day-to-day safety record is impressive, and even more so when compared to coal, or oil and gas production that results in many deaths every year (not to mention longer term air and water pollution health impacts). However, there is a history of rare but catastrophic problems, headlined by familiar names like Fukishima, Three Mile Island, and Chernobyl. The nuclear lobby regularly assures us that such problems are either in the past or readily avoidable with the latest technology but, whether or not they are correct, polls suggest a substantial majority of the public does not believe them, and few communities who have the choice want a new nuclear plant built anywhere nearby.

Waste. Like CCS, nuclear waste involves finding safe storage solutions that can stand for not just years or even decades, but centuries. That leads straight to the door of the government. Unfortunately, the U.S. has compounded the problem by the Yucca Mountain fiasco, which leaves a constantly growing pile of high-level nuclear waste sitting at the more than 100 sites across 37 states where it was generated. Other developed countries, such as the UK, have similar problems.

Liability. The private sector will simply not build nuclear plants in the U.S. without some form of liability protection, leading us again straight to Washington. The Price-Anderson Act established a capped liability (currently ~$13B) in the event of a major incident; it is based on a fund supported by nuclear operators, with the feds on the hook for any additional costs. This is yet another implicit (but not by energy market standards, particularly large) annual subsidy though estimates vary widely—between $1M a year (CBO) and about $500M a year (SIEPR) in today’s dollars.

Cost. Nuclear is a rich man’s game; in the U.S. capital costs[3] are so high that the cost of one plant can equal the entire market capitalization of the utility building it. Hence government loan guarantees, both here and around the developed world. Even in developing countries, where labor and materials are cheaper and regulatory delays less likely, these kinds of costs are still a huge barrier. Emerging technologies for smaller and cheaper reactors may help, and a price on carbon would certainly justify some of these costs.[4]

Right now we in the U.S. are faced with the choice of (1) actively expanding nuclear power to help meet climate concerns, (2) following Germany and abandoning it on safety/ethical grounds, or (3) letting it wither on the vine. Without any comprehensive debate over the four issues discussed above, the U.S. has defaulted for the “wither on the vine” option (regardless of anything EPA says in the CPP). Which means that the quantity of energy production that renewables have to replace is even more challenging.

Even if technology were to solve the safety issues to the point where the wider public would actively support or even tolerate a lot of new nuclear power, the waste, liability, and cost issues mean a very large unavoidable, and potentially expensive, government role. Thus, even if the environmental community warms to the next generation of modular reactors, Washington must also (a) solve the waste problem, and (b) comprehensively address the nuclear financial regime, i.e., make it more transparent and put it on a level footing with renewable support, preferably in our view though a carbon tax.

We think this is unlikely to happen.

So we have to ask: what if there really is no future nuclear capacity? Realistically it means that we must accept the production and potential price implications of a baseload role for gas, and / or moving much faster on CCS. CO2 storage is almost as expensive, and as long lasting a problem, as nuclear, and arguably it is a far more widespread intrusion into society than a single remote and dedicated nuclear waste repository. So the post-Chernobyl battle to get rid of nuclear growth has clearly mostly been won (outside of China), but perhaps at the expense of an important potential tool in tackling climate change.

Fixing nuclear’s problems is a vast challenge, but doing without it may be even harder, and this question needs much more public discussion than it is getting right now.

[1] Note that these numbers are total energy use, not just electric generation, where these renewables have increased their global share to about 5% over the past 20 years.

[2] E.g, IPCC WGIII, AR5 SPM Table 2, or more tellingly, “A Critical Review of Decarbonization Strategies…” Loftus et al, WIREs Clim Change 2015, 6:93–112. doi: 10.1002/wcc.324

[3] EIA puts Overnight (i.e. built today) Capital Cost per KW for new nuclear at around $5.5K, compared to $3K for coal, $1K for gas and $2K for onshore wind. These costs exclude project finance, nuclear waste disposal or government liability guarantee costs. Southern’s delayed Plant Vogtle 2500MW expansion (not a greenfield site) is expected to cost around $16B, and costs have escalated sharply in recent years.

[4] Proliferation is also an important issue but the apparently flourishing Pakistan and North Korean nuclear weapon export industries suggest that persuading the developed world not to build new civilian nukes isn’t going to fix it.