Income inequality has increased dramatically in the United States since the 1970s. Despite the enormous attention that universities and media organizations have devoted to the topic in the last decade, many common perceptions about the causes and consequences of rising economic inequality are misleading or even false. For instance, many citizens, policymakers, and researchers believe that:

- All of the gains from economic growth over the last half-century went to the top one percent (or 10 percent) of the earnings distribution, and incomes in the bottom half of the U.S. income distribution have actually declined.

- A poor child’s odds of advancing in the U.S. occupational structure have substantially declined over the last half-century.

- Rising employer market power, tax cuts, and de-unionization explain most changes in wage inequality in the long run.

In a recent article in Capitalism and Society with Xi Song and Thomas Coleman, I used first-hand empirical analyses to argue that these three widely held views are, in fact, myths. Instead, we found that:

- Income growth has not been limited only to the top. Inequality has increased – the bottom grew more slowly than the top – but the bottom did grow. Furthermore, transfers and taxes somewhat reduced the increases in inequality.

- A poor child’s odds of advancing in the U.S. occupational structure have remained about the same for the last century. Income inequality fluctuations have simply not had big effects on intergenerational mobility.

- The supply and demand for skills and educated workers explain much of earnings inequality over not only the past 50 years, but the past century. Employer concentration, and employers’ market power, i.e. their ability to set lower wages for workers, plays a role in the short-run, but it appears to be small. As a result, minimum wage policies play almost no role in income inequality.

Claims about income inequality’s growth and socioeconomic mobility must confront the historical record. A root cause approach to reducing economic inequality should focus on human-capital inequalities rather than issues of industrial organization.

Did the top 10 percent take all the growth?

A number of authors have argued that the top 10 percent of the earnings distribution have absorbed all recent gains from economic growth and that the rest have seen “their incomes stagnate or decline.” Over the last half-century, the rich have indeed gotten richer, but the poor simply have not gotten poorer, particularly after accounting for taxes and transfers.

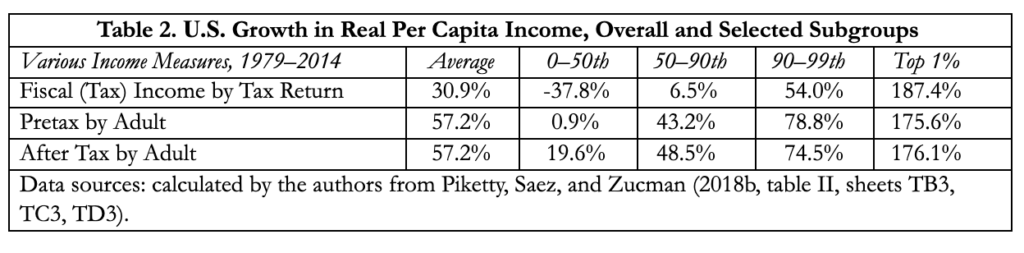

Piketty, Saez, and Zucman’s account of the rise in income inequality is the most pessimistic credible account of inequality’s rise, and so it makes a helpful baseline against which to compare other findings (Piketty, Saez, and Zucman, 2018a). Table 2 from our paper shows data published by Piketty, Saez, and Zucman (2018a, PSZ hereafter). It supports the popular narrative that U.S. pre-tax and transfer incomes in the top one percent have doubled while the bottom half has stagnated or fallen.

We need to start with “Fiscal Income by Tax Return,” the measure used in the 2003 Piketty and Saez study that, in many respects, re-energized interest in inequality measurement. Using income reported per tax return (“tax income”), the top one percent’s income more than doubled (up by 187 percent), and the bottom half’s income fell by an extraordinary 37.8 percent. If this sounds unbelievable, it is, and for the simple reason that “tax income” is not always what we think of or want to use for measuring income.

First, it misses some sources of income – not only through misreporting and fraud (an important but separate issue) but also because “income” reported on a tax form is for assessing taxes, and does not perfectly correspond to spendable income available to an individual or family. Nearly 40 percent of national income is not reported on tax returns (for example, Social Security income was not included before1984 and is included in tax income only for higher income returns—see the Gerald Auten paper in Capitalism and Society). Income from tips, transfer income from the federal government like TANF, in-kind transfer income like Medicare, and housing subsidies are not usually taxable and thereby omitted from these calculations.

Second, tax income distribution is measured for tax returns, not people. We care about people or families, and not the artifact of whether people report taxes jointly or singly. This might not matter except that, among other factors, marriage rates have fallen substantially in the bottom half of the distribution since 1979 but declined only slightly (if at all) at the top. This mechanically reduces the reported income per return in the bottom half and pushes income into the top. The original “Fiscal Income” measure is simply not very useful.

Responding to criticism, PSZ (2018a) broadened their income definition (to cover all national income) and measured the distribution by the number of adults (instead of tax returns), as shown in the second row of Table 2. This measure shows substantial growth at the top, but now the bottom half does not decline but is merely stagnant. One important benefit of the expanded income measure is reporting pretax and after-tax income. PSZ shows that tax policy increased the real income of the lower half of the income distribution. Indeed, tax policy has been surprisingly progressive.

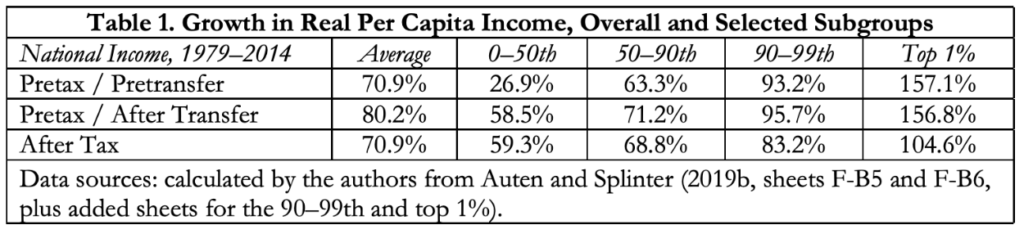

Evidence-based policy for reducing persistent economic inequalities, and potential downstream consequences of that inequality, must first start with a recognition of how much post-tax and transfer income inequality has truly grown. In fact, the PSZ account is the most pessimistic account of inequality and remains contested. As Auten (2021) argues in a companion paper to ours, “the best available evidence suggests that top income shares are lower and have increased less than some have claimed and that real incomes have increased over time for all income groups.” We show this in Table 1 income estimates from Auten and Splinter (2019a) that we believe are more representative than those of PSZ. The pretax/pretransfer rows reflect the incomes obtained from the market before taxation or transfer income, e.g. Medicare. The second row reflects the impacts of transfer income like Medicare and TANF, but not taxation. The final row accounts for both transfer and tax income. A major change is that Auten and Splinter measure income per person rather than per adult, and this alone accounts for a large difference in overall income growth. For instance, households at the top of the income distribution are usually those with individuals reaching their income peak over the life course. Those households often have children, and accounting for the presence of those children reduces the apparent increase in overall income inequality.

No matter how you slice the data, pretax, and pretransfer inequality grew—Austen and Splinter report that pretax income for the top one percent grew 157.1 percent versus only 26.9 percent for the bottom half. But this disparity is less than reported by PSZ. Regarding transfers and taxes, the estimates from Auten and Splinter show that transfers substantially add to income growth for the lower half of the distribution, while taxes reduces growth of the top one percent. Overall, these facts suggest that the U.S. tax and transfer system mitigated inequality increases and generated increasing incomes for any particular part of the income distribution over time. After accounting for changes to household structure and transfers, the picture that emerges is one where all income quantiles experienced real income growth, but incomes grew was faster as one moves closer to the top. Politicians and scholars should more clearly delineate the problem of slow post-tax and transfer income growth for the less-well-off from perennial worries about the immiseration of the working class.

Does rising income inequality reduce intergenerational social mobility?

Scholars and policymakers have voiced concerns that rising income inequality in recent decades is jeopardizing the American principle of equal opportunity. Former President Barack Obama stated in 2013 that “greater inequality is associated with less mobility between generations. That means it’s not just temporary; the effects last.” His remarks reflected the latest available cross-country research at the time, which demonstrated an inverse relationship between intergenerational mobility (as measured by the parent-offspring income correlation) and Gini coefficients in some OECD countries.

In general, researchers find that correlations between earnings of offspring and their parents are higher in countries with higher Gini coefficients than in those with lower inequality. However, a long body of research has not found this correlation within the U.S. over time. Recent advances in Census linking have enabled the estimation of intergenerational mobility for almost two centuries. Social science historians construct rankings of occupations across time to evaluate how open the opportunity structure of a region is. In these exercises, social scientists try to predict their son’s occupational rank from the father’s occupational rank. A higher correlation indicates a more closed society with lower social mobility. I present one chart of correlations between the occupational ranks of fathers and sons from a recent study (Song et al. 2020) doing so below:

Figure 1: Changes in U.S. Social Mobility Over Time

These findings replicate many prior findings over more limited periods or using other socioeconomic mobility measures. They suggest that relative social mobility did not fluctuate much under a wide variety of policy regimes. The overall trend of mobility stability is resistant to most social changes in U.S. history, including the influx of low-skilled immigrants from Europe, the mass internal labor movement caused by the Great Migration, the world wars, the Great Depression, the rise and fall of blue-collar workers, and the more recent economic inequality takeoff. These findings suggest intergenerational mobility is very sticky and largely insensitive to changing distributions of income and wealth in a society.

Contrary to public perception, most of the decline in mobility happened before the 20th century rather than more recently. It appears largely driven by the movement of children from agricultural backgrounds to manufacturing jobs during industrialization. Although income inequality has risen since the late 1970s, the trend in social mobility has remained largely stable in recent decades. Rising economic inequality may have changed the overall upward or downward mobility opportunities for some children, especially in the most disadvantaged neighborhoods. Still. relative mobility chances among children from different social origins have been remarkably stable. On the one hand, policies and programs claiming to increase mobility have not been successful. On the other hand, there has been no rise in immobility over the last 40 years.

There are two potential responses to these facts. One response might be for policymakers to set their sights lower regarding intergenerational social mobility, which has remained stable across a wide variety of U.S. policy regimes. Politicians might better serve the public by directing their limited attention to social problems that are actually responsive to government intervention. Some politicians might alternatively respond that credibly increasing socioeconomic mobility will require far more radical policies than can be found in the U.S. historical record. Given the current (limited) state of knowledge about the fundamental causes of socioeconomic mobility, even radical interventions are likely to fail. Congress should increase its investment in historical economic and social science data and research to learn more about the determinants of upward and downward social mobility.

Is earnings inequality primarily about rapacious employers or education and skills?

Policymakers have honed in on monopsony, or the presence of a single major employer in an area, as a source of rising wage inequality. Corporate power is often considered a source of inequality and antitrust enforcement is a means of reducing inequality. Still, the evidence suggests that employer concentration is not a significant determinant of wage inequalities over the long run. It follows, then, that anti-monopsony policies, focused on ensuring a variety of employers in a given area will not remediate rising market-driven income inequalities.

The preponderance of evidence indicates that a crucial driver of the pre-tax, pre-transfer inequality increase in recent decades is rising educational premiums—the higher wages paid to those with more education and skills. For instance, Autor, Goldin, and Katz (2020) find that a very simple model in which the demand for skilled labor simply increases over time—and sometimes outpaces the number of college graduates—can explain over a century of educational wage premia in U.S. Higher wages for the more skilled are the result of market supply-and-demand forces: Increased demand for skilled labor (the result of technological change) combined with slow increases in the supply of skilled labor.

I am not aware of any competing evidence showing that monopsony power plays a major role in earnings inequality over the long run. In fact, there is some evidence that the role played by employer concentration in the most recent inequality increase since the 1980s is small. In other words, changes in demand for high-skilled workers, combined with individual and household choices about human capital investment and education (together with the social and political investments that determine our educational infrastructure) comprise the primary driver of earnings inequalities.

Market forces can drive inequality up or down. In the first half of the 20th century, the U.S. saw a “great compression” in inequality that, as with the rising inequality of the past 40 years, appears to have been driven substantially by supply and demand for education and skills. With the high school movement, the first half of the 20th century saw increased educational attainment and substantial increases in the supply of educated and skilled labor. This same logic implies that, relative to demand, the supply of highly educated and skilled workers has not kept up. This shortfall in the relative supply of highly skilled workers has caused wage inequality to increase.

Human capital investment is a slow-moving, cumulative process. Absent major, unprecedented technological shocks biased in favor of the less skilled, it is almost a foregone conclusion that today’s high school, college, and graduate students will face higher income inequalities than their grandparents faced. Remediating cognitive and social deficits for an 18-year-old is hugely expensive while investing in the very young to ensure robust adult skills has a payoff measured in decades, not years.

Policies that encourage human capital investment and cognitive enhancement—for example, a child tax credit that incentivizes parental investment—or policy reforms that ensure every current kindergartner would be college-ready after high school would, in the long run, radically reduce labor market inequalities. Yet it would take a little less than two decades before they made a detectable impact on earnings or employment. Although the current research admits some role for labor market institutions in determining the contemporary level of wage inequality, changes to labor market institutions simply will not restore 1960s levels of earnings inequality.

Conclusion: Can we learn to live with inequality?

Depending on your vantage point, understanding the historical trends in income inequality provides reasons for both optimism and pessimism. On the one hand, taxes and transfers have successfully generated income growth for most, perhaps all, income distribution since the 1970s. On the other hand, those committed to freer markets might be disturbed by the dependence of less-well-off households on government redistribution for economic advancement.

One could argue that the status quo is insufficient, and that “our political and economic systems will collapse absent solutions” which generate faster income growth for the middle- and working-classes, but arguments that rely on these classes having collectively lost economic ground are not supported by data. Given the historical record, changes to tax and transfer policy could generate additional income growth for the have-nots, although they will not solve the root causes of income inequality over the last half-century. Proposed changes to the tax code and transfer payments must be balanced against dynamic considerations, such as potential decreases in growth and investment and opportunities for government abuse arising from policy changes.

Regarding the causes and consequences of rising economic inequality, whether the glass is half-full or half-empty similarly depends on where you sit. Overall socioeconomic mobility has not changed much in the U.S. over the entire period for which researchers have data. If you were pessimistic or optimistic about the opportunity structure for White males in the 1850s and 1950s, then the data gives no special warrant for changing your opinion now. Furthermore, for women and African-Americans, the opportunities for social mobility have almost certainly increased since both the 1850s and the 1950s.

One’s opinion on the prospects for reducing long run income inequality should ultimately depend on how much one believes cognitive abilities and educational attainment can be increased, and over what time frame. Policies promoting high-skilled immigration, educational reforms, and perhaps more sophisticated early identification of talent would all address the root causes of recent U.S. income inequality growth, but would work on different time frames. In principle, increases in high-skilled immigration would boost earnings for less-skilled workers in the U.S. almost immediately, while schooling reform is a long-term and uncertain process that, at best, would take more than a generation to reduce earnings inequalities.

Although the recent increase in U.S. inequality emerged more out of technological changes than policy shocks, reducing it will depend on knowledgeable responses by policy entrepreneurs in the next few decades. Understanding the magnitude, mobility consequences, and origin of the continuing inequality increase is the first place to start.

Michael Lachanski is a joint doctoral student in demography and sociology and MA student in Statistics at the Wharton School at the University of Pennsylvania. He works on computational social science methods for the study of historical social mobility, historical social policy, and crime. He holds an MPA concentrating in economic policy and A.B. in Economics from Princeton University.

REFERENCES

Autor, David, Goldin, Claudia, and Katz, Lawrence F. 2020. “Extending the race between

Education and Technology.” AEA Papers and Proceedings (Vol. 110, pp. 347-51).

Auten, Gerald. 2021. “Recent Research on Income Distribution: An Overview of the Field.” Capitalism and Society 15 (1). https://papers.ssrn.com/abstract=3985575.

Auten, Gerald, and David Splinter. 2019a. “Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends.” http://www.davidsplinter.com/.

2019b. “Online Appendix to ‘Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends.’” http://davidsplinter.com/AutenSplinter-IncomeIneq.xlsx.

Piketty, Thomas, and Emmanuel Saez. 2003. “Income Inequality in the United States, 1913-1998.” The Quarterly Journal of Economics 118 (1): 1–41. https://doi.org/10.1162/00335530360535135.

Piketty, Thomas, Emmanuel Saez, and Gabriel Zucman. 2018a. “Distributional National Accounts: Methods and Estimates for the United States.” Quarterly Journal of Economics 133 (2): 553–609. https://doi.org/10.1093/qje/qjx043.

2018b. “Online Appendixes to ‘Distributional National Accounts: Methods and Estimates for the United States.’” Quarterly Journal of Economics 133 (2): 553–609. http://gabriel-zucman.eu/usdina/.

Song, Xi, Michael Lachanski, and Thomas Coleman. 2021. “Three Myths About US Economic Inequality and Social Mobility.” Capitalism and Society 15 (1). https://papers.ssrn.com/abstract=3985601.Song, Xi, Catherine G. Massey, Karen A. Rolf, Joseph P. Ferrie, Jonathan L. Rothbaum, and Yu Xie. 2020. “Long-Term Decline in Intergenerational Mobility in the United States since the 1850s.” Proceedings of the National Academy of Sciences 117 (1): 251–58. https://doi.org/10.1073/pnas.1905094116.

Photo Credit: iStock