Many American families and workers are feeling the burden of high mortgage and rental rates — a fact that recently found a high-profile (and unlikely) proponent on Twitter. What many do not realize is that the two are linked.

As of September 1, mortgage rates were at their highest since the market crash in 2008, 5.89 percent. As a result, people who are looking to buy a home are facing the squeeze of high mortgage payments for a given home price.

What’s more, many people aren’t just being pushed into a less expensive home. Thanks to rising rates, many are pushed into a less expensive home or condo, some people get forced out of the home purchase market altogether. What do they do then? Mostly, they continue renting. The home purchase and the rental markets are firmly linked. In most cities and at most times, there is a churn within the home rental market as life circumstances change, as people move into larger units through income increases or buy starter homes after forming a family.

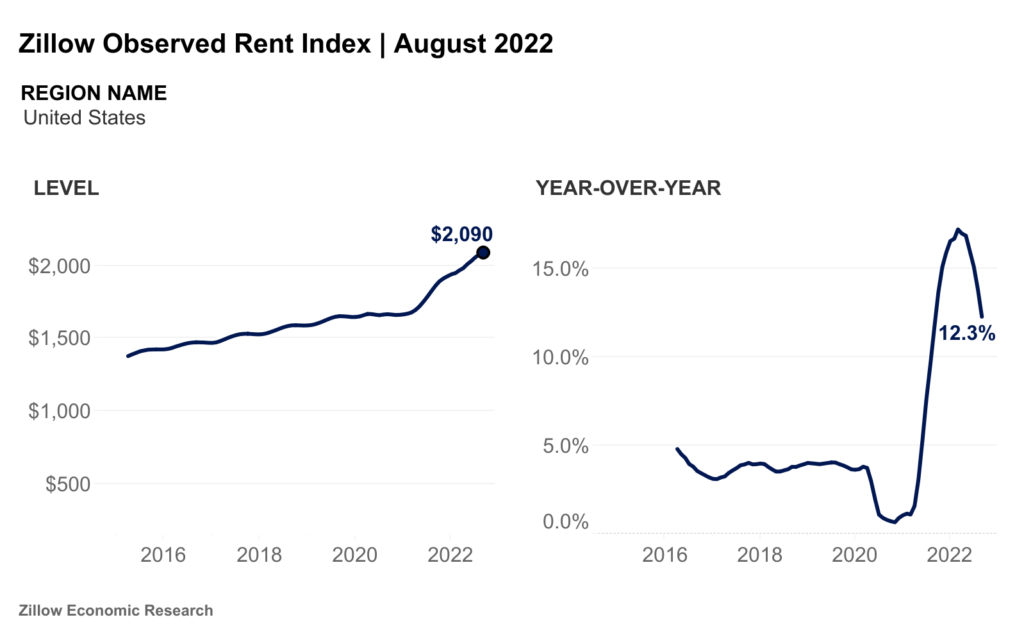

But when mortgage rates go up, that churn between rental unit types and homeownership slows; instead, families unable to purchase starter homes remain in the rental market. Like a snake swallowing a rat, the glut of renters with no place to go strains the system. But unlike a snake, the supply of rental housing is not highly elastic. Since demand for housing will remain high, rent prices will remain high. The most recent monthly report from Zillow shows that increased mortgage rates correlated with average rents, from $1,600 per month to over $2,000 from February 2021 to August 2022.

Higher interest rates push land and home prices lower relative to renting the same property. Some relief follows as topline home prices fall, but monthly mortgage payments — including both principal and interest — for consumers stay as high or higher than before the rate increase.

So what do we do? First, we need to recognize that home purchase and rental markets are linked. Second, we should understand that people naturally move around in a healthy housing market. When they can’t move with their life circumstances — especially when the housing supply does not accelerate with labor and population growth — the market gets clogged, and prices increase. Finally, the best way to protect renters from high mortgage rates affecting the home rental market is to ensure a flexible and growing housing supply for renters and owners.

When housing supply of all kinds grows with demand, price increases aren’t as bad compared to when housing is broadly scarce. Reforms like allowing homeowners to build accessory dwelling units in their backyards or allowing developers more flexibility to build when prices increase are the best way to protect renters and future owners alike from rising interest rates.

Photo Credit: iStock