This piece is part of a series of briefs looking at specific state proposals for family tax benefit reforms based on a larger Niskanen report, The State of our Families: Child and Dependent Tax Benefits in the States. You can find other state briefs here.

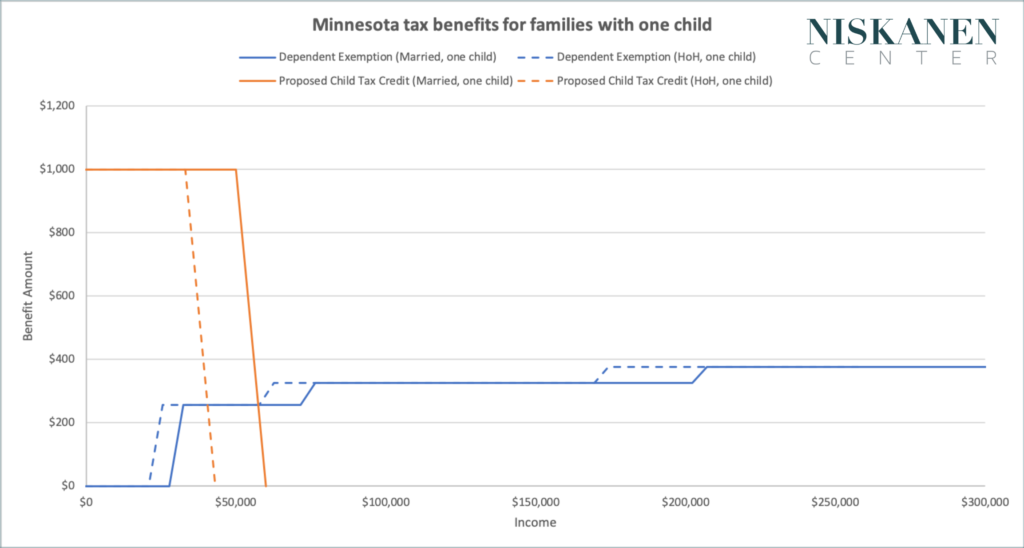

As part of his new budget, Governor Timothy Walz (MN-D) has proposed introducing a new state-level $1,000 child tax credit (CTC) for children under 18 years old and some disabled adult dependents. As Figure 1 indicates, the new CTC would be a marked departure from the state’s traditional reliance on a dependent exemption to support families.

Figure 1: Distribution of dependent exemption and proposed CTC benefits

Benefits

The credit is fully refundable. Families can claim the credit regardless of their income or tax liability. This is crucial for extending the tax credit’s benefits to low-income families who are in most need of support but are typically excluded from other tax benefits because the state’s standard deduction wipes out most or all of their tax liability.

The maximum credit amount is generous and reaches a broader age range than most other state credits. Among states with similar CTCs, credit amounts range from $100 to $1,000 per child. The more generous credits tend to limit eligibility to children under six. Minnesota’s CTC would extend to all children under eighteen years old and some disabled adults.

The credit is indexed, which means it will automatically adjust each year to prevent its real value from being eroded by inflation.

Drawbacks

The credit is highly targeted based on family income. The full $1,000 credit threshold is $33,000 for single parents (heads of household) and $50,000 for married couples. After this threshold, the credit is phased out by $100 for each additional $1,000 in income. The relatively low thresholds, paired with a 10 percent phase-out rate, can create marriage and work penalties for many families. For example, a single parent with one child who moves from a minimum to a median wage job would lose their entire $1,000 credit. Similarly, a minimum wage worker with one child would lose almost all of their credit if they married a median wage worker.

The maximum total credit amount available to families caps at $3,000 per year, penalizing larger families since the credit amount is effectively $0 for any child after the third.

The credit is layered atop Minnesota’s existing dependent exemption, which also provides support for families with children. This creates two drawbacks. First, families must navigate a complicated maze of overlapping benefits where they may find their child tax credit phasing out as their dependent exemption is phasing in as their income rises. Second, it misses the opportunity to reduce overall costs while making all families better off by consolidating and streamlining benefits.

Improvements

The most straightforward way to improve the credit is to eliminate the phase-out altogether and offset some of the cost by removing the dependent exemption. This would eliminate work and marriage penalties and make all families better off. Still, the drawback to this approach is that the cost is likely to be prohibitively expensive.

Alternatively, a more fiscally responsible incremental reform might involve:

- Ensuring the phaseout threshold for married couples is double that of single heads of household (e.g. $33,000 and $66,000).

- Reducing the phase-out rate from 10 percent to 5 percent

- Phasing the credit down to $380 (close to the maximum value of the dependent exemption) rather than phasing it out altogether.

Eliminating the dependent exemption would cover much of the cost of these changes. It would reduce penalties, simplify access, and broaden the credit’s benefit to more families making less than the state’s median income.