An important debate is occurring over how a permanent extension of the 2021 Child Tax Credit (CTC) would impact poverty and parental employment. Public policy is all about weighing tradeoffs, and that depends on having accurate and robust estimates of a policy’s key costs and benefits. Yet estimates of the number of parents who would choose to stop working in response to a permanent CTC expansion vary widely, ranging from 300,000 to 1.5 million depending on various assumptions.

In new research, I argue that the likeliest number is at the lower end of this plausible range — around 410,000. I further show that even under the scenario of the largest employment decrease, the CTC would still lead to an unprecedented decrease in child poverty. In fact, I conclude that the 2021 version of the CTC would reduce poverty — and deep poverty — by more than the 2020 CTC and Earned Income Tax Credit (EITC) combined.

The work incentive debate, explained

The work incentive debate remains a thorny and often confusing issue. To understand why the CTC expansion would decrease labor supply, it helps to explain why another tax credit — the EITC — increases labor supply.

The EITC can be thought of as a wage subsidy. Every dollar earned by a low-income family with 1, 2, or 3 kids is worth an extra $0.34, $0.40, or $0.45, up to a maximum amount. Consider a family with three children earning $10,000 a year. When this family files their tax return, they get a refund — in effect, a negative tax instead of paying taxes. For this family, the refund would be $4,500, so their after-tax income would be $14,500. There is abundant empirical evidence that this wage subsidy aspect of the EITC has encouraged many lower-income parents (especially unmarried mothers) to join the labor force and work for pay, rather than caring for their children at home without pay.

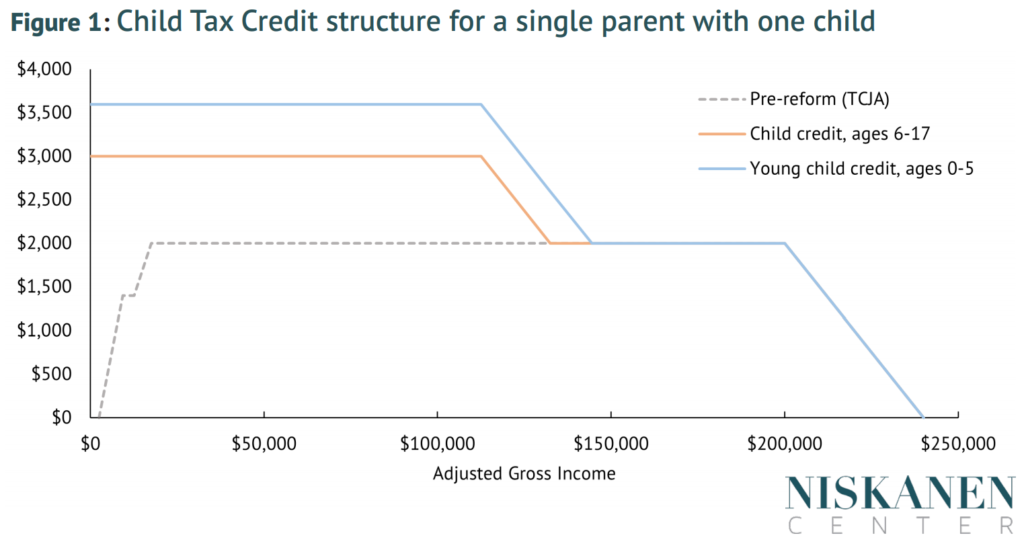

Before 2021, the CTC encouraged work in the same way as the EITC — phasing in with earnings and growing up to a limit — though the benefits of the CTC were much smaller and had a correspondingly smaller impact on the employment decisions of parents.

The 2021 CTC changed the structure of the CTC in some important ways. For one thing, it became more generous for all families. At the same time, instead of phasing in with earnings (like the EITC), benefits were available to all low-income families, whether they worked and had earned income or not. Instead of having the structure of a “negative income tax” where benefits increased with every dollar earned, the CTC became more like a modest universal basic income for households with children, regardless of their labor-force status.

These changes meant that benefits became more generous to the poorest families. Ignoring behavioral responses to this change, I estimate that about 3.5 million out of 11 million poor children would be lifted out of poverty by this approach to the CTC — a 31 percent reduction in child poverty. The impact on deep poverty (family income below 50 percent of the poverty line) is even larger: About 1.5 million of 3 million children would be lifted above the deep poverty threshold — a massive 52 percent reduction.

Tradeoffs and side-effects

Economists often point out that public policies have unintended consequences. The 2021 CTC is no exception. In this case, the tradeoff would be a major reduction in child poverty in exchange for a modest increase in the average tax rate facing low-income families, which would induce some parents to reduce their work hours or stop working. How many parents would stop working? This depends on two factors:

- The magnitude of their average-tax-rate change, and

- How responsive families are to these tax changes (i.e., their “labor supply elasticity”).

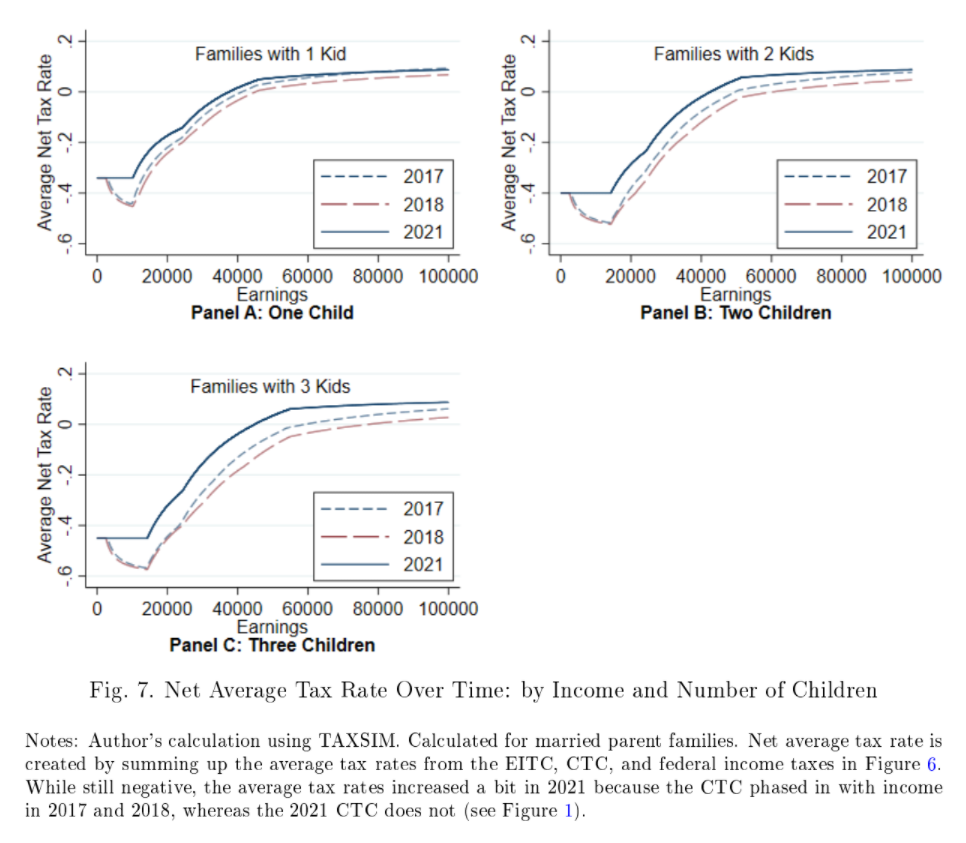

The first factor is not controversial. Each family’s tax rate change depends on their taxable income, number of children, and marital status. The average effective tax rate increase from making the CTC fully refundable is 6.5 percent, but the effect ranges from 3 percent to 17 percent. Most families earning less than approximately $50,000 face a negative average tax rate thanks to the EITC. As such, to say their average tax rate increases under the CTC expansion is really to say that it becomes less negative. For example, the average tax for an EITC family might change from -40 percent to -33 percent. The EITC would still subsidize work, but the 2021 version of the CTC would slightly reduce the wage subsidy, as illustrated below.

The second factor is more controversial: How many workers will stop working in response to these tax rate changes? Evidence suggests that the average person’s labor supply elasticity is about 0.25, meaning that a 10 percent increase in the tax rate will decrease labor supply by about 2.5 percent. For example, a 6.5 percentage point increase in the marginal tax rate with an elasticity of 0.25 would be expected to decrease labor supply by about 1.6 percent (=6.5 percent x 0.25).

About 50 million parents are now working, meaning that about 800,000 parents may choose to stop working using the average elasticity. However, applying elasticities is complicated by the fact that elasticities and tax changes vary by subgroups. I account for these differences by choosing elasticities based on previous economics evidence: participation elasticities are very small for men (around 0.05), a bit larger for married women (around 0.2), and largest for lower-income, unmarried mothers most affected by programs like the CTC and EITC (around 0.4). While these are my preferred numbers, elasticities that are a bit higher or lower could also be justified.

Using these elasticities applied to each individual’s tax change, I calculate that about 410,000 workers would choose to stop working were the 2021 CTC expansion made permanent.

The final step is to examine how these dynamic employment changes affect the CTC’s anti-poverty impact. By dropping out of the labor force and reducing earned income to zero, some previously non-poor families may become newly poor, and some previously poor families that would have been lifted out of poverty by the pre-2021 CTC may revert to being poor.

As a result, I estimate the dynamic reduction in child poverty resulting from the 2021 revisions to the CTC would be 27 percent, representing 3 million children. The corresponding reduction in deep poverty would be a larger 42 percent, representing 1.3 million children. These are smaller than my static estimates of 31 percent and 52 percent given above, which ignored effects on labor supply. Even so, they represent staggering decreases in poverty.

Dueling estimates

These results challenge a 2021 study by Kevin Corinth and colleagues that has received a lot of attention. That study assumes larger labor supply elasticities than the ones I have used, and finds that the CTC would lead 1.5 million parents to stop working, or 2.6 percent of all working parents. The authors claim that this employment reduction would have a large offsetting effect on the anti-poverty impact of the CTC, resulting in zero overall effect of the CTC on deep child poverty. However, even using their own elasticity assumptions, I find that their claims about the CTC’s effects on poverty are not accurate.

By using the same labor supply elasticities, I am able to replicate the simulated effects given by Corinth et al. on employment and child poverty. I find that the dynamic reduction in deep child poverty would be 30 percent, not so different from the 42 percent I calculate using my preferred elasticities.

My own research shows that regardless of whether the CTC leads 300,000 or 1.5 million parents to stop working, the result would still be a large reduction in poverty. The reason that decreases in employment have a relatively small effect on poverty is that the few poor adults who stop working remain poor, while most non-poor adults who stop working are kept out of poverty by other sources of family income. Those sources include earnings from other family members and various sources of unearned income, such as retirement benefits and public assistance.

Why do I come to such different conclusions about the effects of the change in CTC structure on child poverty than Corinth et al.? One reason is that their study restricts the employment impact on couples to just two cases: either both spouses stop working, or neither spouse stops working. In contrast, I assume that each adult independently decides whether or not to stop working.

Clearly, for some couples, the response to changes in CTC policy would be for one parent to stop working and one to keep working. This is what was observed in Canada, where the introduction of a child benefit primarily reduced employment among a subset of married mothers with a working partner. The assumption that both spouses stop working means that families that reduce their labor supply in the Corinth et al. model suffer a much larger loss of total family income. While other factors may also contribute to the differences between our estimates, their use of confidential data leaves me unable to do a full accounting.

In short, the 2021 CTC expansion is one of the most important policy changes since the welfare reforms and EITC expansions of the 1990s. Even though full refundability will lead some parents to decide to stop working, the 2021 estimates from Corinth et al. likely overstate the impact. Using reasonable assumptions, I find the labor supply impact is likely to be modest. Given the large reduction in child poverty that would result, making the CTC expansion permanent, therefore, seems well worth the tradeoff.

Jacob Bastian is an Assistant Professor of Economics at Rutgers University, New Brunswick, New Jersey. His research focuses on how public policy can reduce poverty, increase economic opportunity, and affect social attitudes, while also identifying unintended consequences.

Photo Credit: iStock