This piece is part of a series of briefs looking at specific state proposals for family tax benefit reforms based on a larger Niskanen report, The State of our Families: Child and Dependent Tax Benefits in the States. You can find other state briefs here.

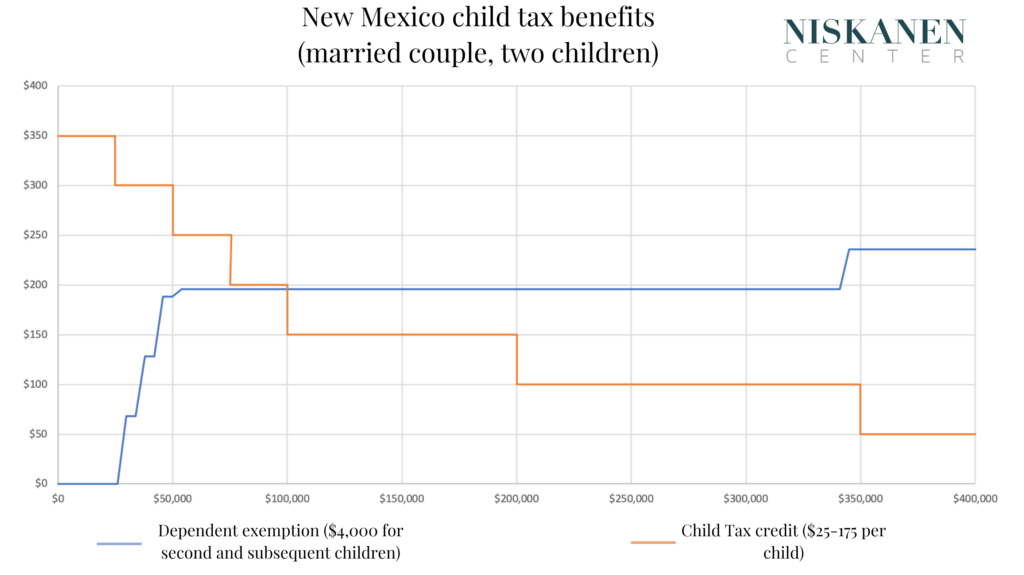

New Mexico policymakers have made two critical changes to the state’s tax code in the past five years. In 2021, they passed a fully refundable tax credit for each child under 17 years old. As a fully refundable credit, there are no income requirements to claim it. The credit is worth $175 per child for families earning less than $25,000 annually. It is reduced after that in six “steps” of income brackets varying in width until reaching $25 per child for families earning more than $350,000 annually.

In 2019, New Mexico introduced a $4,000 tax exemption for each dependent (excluding the first one). Exemptions work by reducing the amount of income subject to income taxes. Depending on the family’s tax bracket, the exemption is worth up to about $68 for those in the lowest bracket ($4,000 x 1.7 percent) to $236 for those in the top bracket ($4,000 x 5.9 percent) for each eligible dependent. Yet families with little or no income cannot benefit from the full value of these exemptions because they typically have little or no income tax liability after claiming the standard deduction.

Figure 1 shows how much a married couple with two children would receive from each tax benefit depending on their income.

These two tax reforms set the stage for two new proposals to expand the child tax credit in the current legislative session, which is currently unindexed and has been subject to substantial erosion in real terms by the past year’s high inflation.

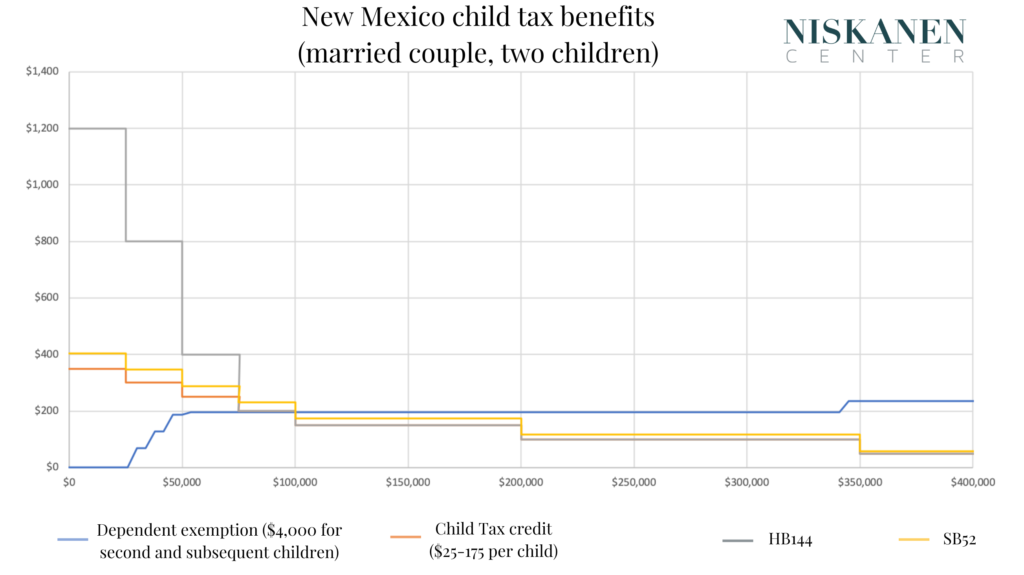

The first–SB52, sponsored by New Mexico Senators Bill Tallman (D) and Pamelya Herndon (D), would increase the credit amount for every income band by about 15 percent (e.g. the $175 would rise to $202). It leaves the current income bands unchanged, and the credit would remain unindexed going forward. The projected cost is an additional $11 million each year.

HB144, sponsored by New Mexico Representatives Christine Chandler (D), Derrick Lente (D), and Elizabeth Stefanics (D) would substantially increase credit amounts for the bottom three income bands – those making less than $75,000 – and index the credit amounts (but not the income bands) going forward. The projected cost is an additional $102-109 million each year.

Figure 2 shows how much a married couple with two children would receive from current and proposed benefits depending on their income.

Benefits

Both proposals’ benefits are straightforward in increasing their generosity for lower and middle-income families.

SB52 would partially reverse the credit’s erosion by inflation at a relatively low cost, compared to the other proposal.

HB 144 would more than make up for inflation erosion for those making less than $75,000, pushing benefit amounts substantially higher than current levels in real terms. The bottom three brackets would see their per child benefit rise to $600, $400, and $200 from $175, $150, and $125, respectively. Additionally, indexation would prevent additional future erosion.

Drawbacks

The drawbacks of these proposals are less about what they would change and more about which aspects of the existing credit they would leave intact. New Mexico’s CTC, as introduced, provided a good foundation for families but, like New York’s child tax credit, contains several significant problems needing reform.

First, HB144 does not index income bands, while SB52 indexes neither credit amounts nor income bands. Whether inflation remains high or drops to more tolerable levels, continued non-indexation is a recipe for benefit erosion over time.

Second, both proposals retain the credit’s “step” structure, which results in troubling benefit cliffs, where an additional dollar of family income can lead to a substantial loss of benefits. For example, under HB144, a family whose income rises from $24,999 to $25,001 would see the credit drop from $600 to $400 – that is, a $200 benefit loss for gaining a mere $2 in income. This structure creates significant work and marriage penalties for families. For example, a single parent earning minimum wage could lose $400 if they marry a partner making just above minimum wage.

Because both proposals would leave New Mexico’s dual system of family tax benefits – a CTC layered on top of a dependent exemption – intact, these work and marriage penalties are less severe for middle-income families with two or more children. The dependent exemption for second and subsequent children would continue to phase in as income rises, offsetting some of the loss associated with the higher drop in CTC benefits. Families would still face unnecessary complexity in this scenario and find it hard to determine what impact any income changes might have on their total family benefits.

Improvements

State policymakers must carefully balance concerns about poverty, work, marriage, complexity, and cost when deciding how to best structure any reform. In this case, the push to reduce poverty by maximizing generosity for lower-income families comes at the expense of exacerbating work and marriage penalties and complexity for all families.

Rather than just increasing amounts for existing benefits, New Mexico policymakers should take this opportunity to simplify and streamline benefits for families. Consolidating the CTC and dependent exemption into a single CTC would simplify the tax code, reduce the cost of expanding the credit to further support all families, and still cut child poverty in New Mexico.

The dependent exemption is expected to cost about $28 million this year, and the CTC is poised to cost about $74 million when it takes effect in 2024. According to their respective fiscal notes, SB52 would cost about $11 million while HB144 would cost about $102 million in their first years. These amounts provide a solid foundation for consolidating both benefits into a single, flat, and universal refundable CTC worth $250 per child and indexed for inflation.

By eliminating work and marriage penalties and offering simpler, more generous benefits, this comprehensive reform would be a win-win-win for New Mexico families.

Photo credit: iStock