In response to the highest levels of inflation the U.S. has seen in over four decades, Senator Grassley recently proposed the Family and Community Inflation Relief Act to help combat this issue. Among other things, the Grassley plan would automatically adjust the Child Tax Credit’s (CTC) value and phase out thresholds for inflation by indexing it.

Indexation is a simple and essential tool that policymakers can use to prevent the subtle erosion of family tax benefits over time. The Reagan administration made a concerted effort to protect families from the impact of inflation by indexing most major tax exemptions, deductions, and credits. The CTC’s predecessor—the dependent exemption—was indexed as part of Reagan’s 1981 tax cuts, and the earned income tax credit was also indexed as part of the 1986 tax reforms.

When policymakers began debating the CTC in the 1990s, inflation was low and stable again. New concerns about deficit reduction eclipsed concerns about the impact of inflation on families. In this situation, non-indexation became more attractive as a way to quietly pursue deficit reduction without the backlash that comes with actively cutting benefits. Despite broad support for the introduction of the CTC in 1997, Congress made no provision to index its value or thresholds. Nor has Congress indexed in the several reforms that followed decades later.

The impact of non-indexation on families

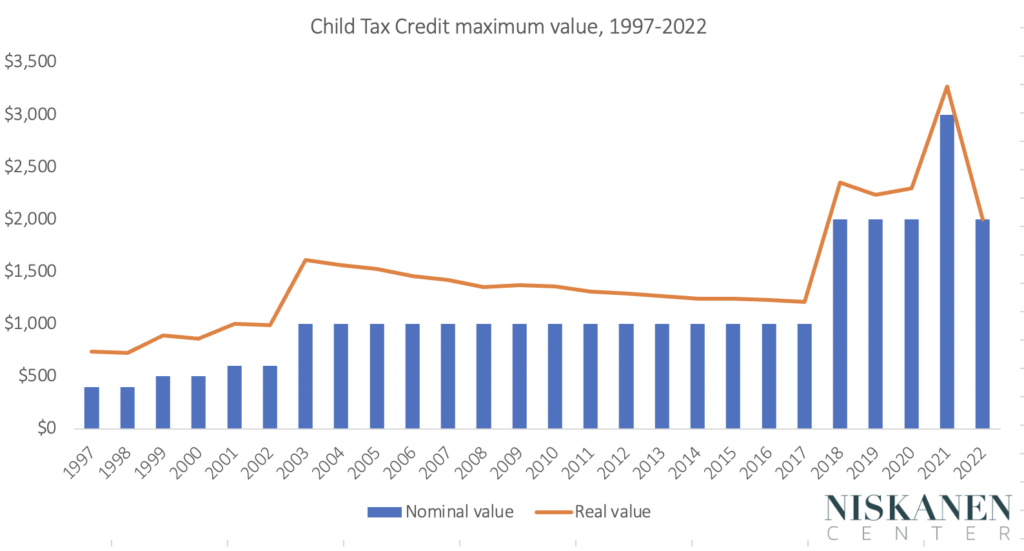

The result has been the steady erosion of the CTC’s inflation-adjusted value interrupted by the occasional legislative expansion. Figure 1 looks at the credit’s nominal and real maximum value from 1997 through today.

A rosier than expected budget outlook in the early 2000s led Congress to expand the CTC several times, initially masking the impact of non-indexation. Yet between 2003 and 2017, the CTC lost a quarter of its real value to inflation. The 2017 tax cuts reversed this. The broader impact was initially masked by consolidating the previously indexed dependent exemption with the CTC. Since 2018, the CTC has already lost 15 percent of its real value to inflation.

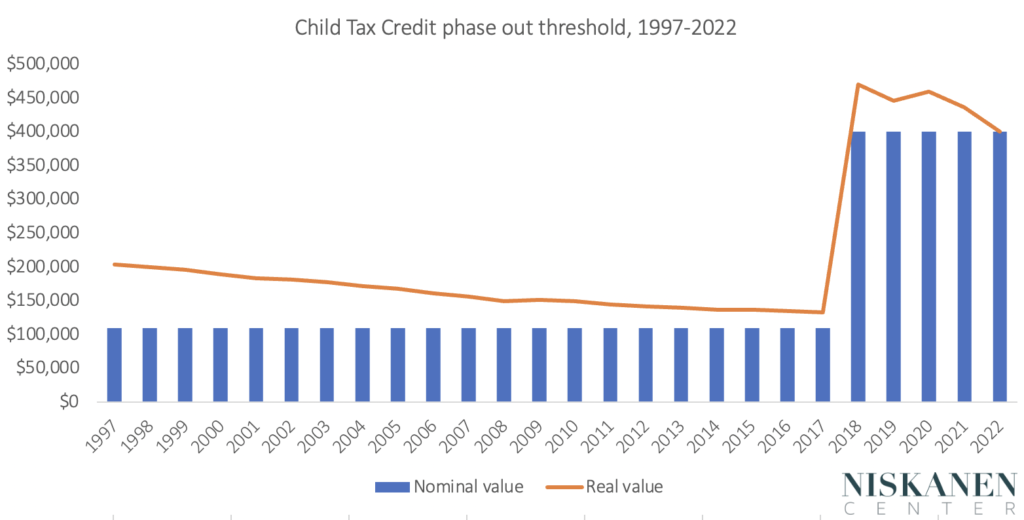

The CTC also has an income threshold after which benefits begin to phase out for upper-income families–and this threshold is not indexed either. Figure 2 looks at the nominal and real phase-out threshold credit from 1997 through today.

We also see similar trends here:—steady erosion with one instance of legislative expansion before erosion proceeds again. Again, the consolidation of the CTC with dependent exemption—which disproportionately benefits higher-income families—masks some of the broader impact of the 2017 reforms.

Time to end the cycle of blame avoidance and credit claiming

Kent Weaver has argued that policymakers are motivated to avoid blame for unpopular actions and claim credit for popular ones. Non-indexation of the CTC is a classic case of allowing policymakers to avoid responsibility for its erosion while claiming credit for the occasional expansion. But what is good for policymakers is bad for families looking for stable protection against inflation. By finally indexing the Child Tax Credit’s value and phase-out threshold, the Family and Community Inflation Relief Act would help break the cycle and provide families with the protection they have lacked for 25 years.

Photo credit: iStock