As the clock ticks on Congress’ lame duck session, advocates and policymakers are eyeing potential bipartisan compromises to expand the Child Tax Credit. Concerns about cost, inflation, and work incentives make it likely that any such compromise will need to build incrementally on the current law. There is general support within Congress for expanding the CTC but little consensus on the details of how it might change.

But any compromise will have to navigate the technicalities of the existing CTC, and that complexity may leave many stakeholders and the public feeling left in the dark. The most likely compromises include 1) indexing the credit, 2) phasing the credit in faster, and 3) making the credit “fully refundable” for infant children only. The rest of this brief provides a primer on the technical concepts involved and what the various options mean for families.

Index the Child Tax Credit to prevent further erosion by inflation

Most exemptions, deductions, and credits in the tax code are indexed for inflation. This means they are adjusted upward each year to account for widespread price increases that might erode their value over time. The child tax credit is not indexed for inflation. As a result, the $2,000 credit passed as part of the 2017 tax reforms is worth about 20 percent less today. It would be closer to $2,400 per child next year if it had been indexed.

One option for Congress is to adopt the indexation provisions from Senator Grassley’s Family and Community Inflation Relief Act. This would not expand the credit to previously ineligible families but would benefit currently eligible families by ending erosion-by-inflation once and for all. Otherwise, the real value of the credit will continue to shrink each year.

Increase the credit’s refundability and phase it in faster

The child tax credit phases in slowly based on earnings and is only partially refundable, which means it may be capped depending on a family’s federal income tax liability. Families must earn at least $2,500 before the credit begins phasing in at a 15 percent rate on the first $1,500 of the credit. The remaining $500 is nonrefundable, so families must have at least $500 in income tax liability to claim the full $2,000. While many members of Congress have reservations about extending the credit to families where parents are unemployed, there is bipartisan support for expanding its reach to include more families where parents are working.

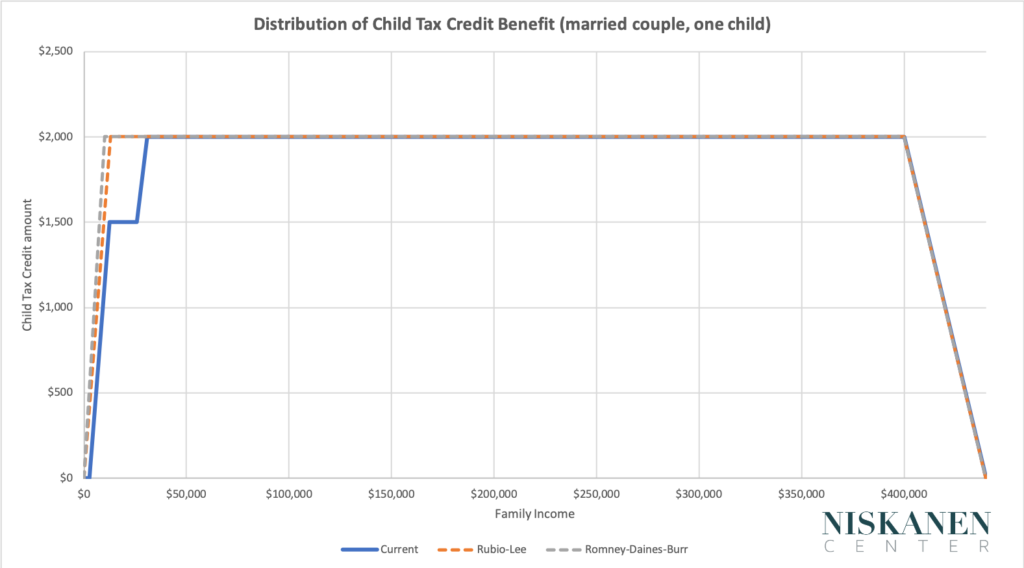

One option for Congress is to adopt provisions from the Providing for Life Act proposed by Senators Marco Rubio and Mike Lee or the Family Security Act 2.0 sponsored by Senators Mitt Romney, Steve Daines, and Richard Burr. Both would eliminate the phase-in threshold, so the credit begins phasing in with the first dollar of income, and make the entire credit refundable so more working families would be eligible for the full $2,000 benefit.

Figure 1

Additionally, the Rubio-Lee and Romney-Daines-Burr proposals increase phase-in rates. The former would increase the phase-in rate slightly from 15 percent to 15.3 percent. The latter provides the full credit to families earning at least $10,000. Below the $10,000 threshold, the benefit phases in proportionally with income. As Figure 1 indicates, the impact of each phase-in rate on families with one child would be similar. Under Rubio-Lee, the earnings threshold for receiving the maximum credits increases with each child, though. Under Romney-Daines-Burr, it would always be $10,000 in earnings. Both would expand the credit’s reach to more working-class families. The Rubio-Lee phase-in provision would cost less but is less beneficial to larger families. The Romney-Daines-Burr phase-in provision would cost more but is more beneficial to larger families.

Make the credit fully refundable for infant children

Under the temporary 2021 expansion of the Child Tax Credit, Congress eliminated the phase-in altogether. This is commonly referred to as making the credit “fully refundable”, which meant families received the full credit regardless of whether they earned $0, $10,000, or $100,000 that year. Many members of Congress were less concerned about the traditional earnings requirements because the pandemic had closed businesses, leaving many workers temporarily unemployed. As the economy roared back, so have concerns about work incentives. One potential exception, in the context of the lame duck session, is in the case of very young children. We see examples of this in popular support for paid parental leave and in the decisions of most states to exempt Temporary Assistance for Needy Families recipients from work requirements when they have infant children.

One option for Congress is to partially adopt the provision from the American Families Act, proposed by Senators Michael Bennet and Sherrod Brown, that makes the credit “fully refundable” only for children under one year old while retaining the phase-in for older children. This would provide new parents with additional income and the ability to spend time with their newborn where access to paid leave is limited or nonexistent without raising concerns about prolonged nonemployment.

Conclusion

All of these options address common concerns about cost and work incentives that held back previous efforts to expand the Child Tax Credit. Each of these options, alone or in combination, would help families by making much-needed improvements to the program. Legislators must now decide whether they should prioritize indexation, faster phase-in, or full refundability for the youngest children — or if they can afford to do all three.

Photo credit: iStock